Why Invitae Stock Rose 23% in Week Ended August 24

On August 24, Invitae (NVTA) stock closed at $12.56, which represents a ~4.75% growth from its prior day’s close of $11.99.

Aug. 27 2018, Published 1:22 p.m. ET

Stock performance

On August 24, Invitae (NVTA) stock closed at $12.56, which represents a ~4.75% growth from its prior day’s close of $11.99. It hit its 52-week high of $12.75 on August 24. On August 23, it rose ~5.83% to $11.99 from its prior day’s close of $11.33.

For the week ended August 24, Invitae stock closed at $12.56, which represents a ~23% rise from its prior week’s close of $10.21 on August 17. It’s been seeing consistent growth since its second quarter financial results were released on August 7.

Reason for the rise in Invitae stock

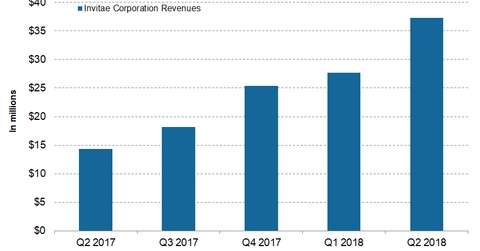

Invitae delivered solid growth in the second quarter of 2018 when it reported revenues of $37.3 million compared to $14.3 million in Q2 2017. That’s a 160% year-over-year growth and a 35% sequential growth. In the second quarter, it generated revenues of $36.35 million in genetic test revenues and $956,000 from other revenues.

In the second quarter, it reported a gross profit of $16.9 million compared to $3.8 million in Q2 2017 and $9.6 million in Q1 2018. It reported a net loss of $31.7 million in Q2 2018 compared to $28.6 million in Q2 2017.

In the second quarter, Invitae added 73,000 samples, which reflected a ~139% year-over-year growth and a 14% sequential growth.

Analyst recommendations for NVTA and its peers

Of the six analysts tracking Invitae in August, two of them have recommended a “strong buy,” three have recommended a “buy,” and one has recommended a “hold.”

Of the eight analysts tracking TherapeuticsMD (TXMD) in August, all of them have recommended a “buy.” Among the four analysts tracking Progenics Pharmaceuticals (PGNX), all of them have recommended a “buy.”

On August 26, Progenics Pharmaceuticals and TherapeuticsMD had consensus 12-month target prices of $15 and $15.86, respectively, which represents ~94.81% and ~161.72% returns on investment, respectively, over the next 12 months.