Are Global Macros Supportive of US Steel Stocks?

Although US steel producers have trade protections in the form of the Section 232 tariffs, the global steel pricing environment still affects US steel prices.

Aug. 18 2020, Updated 5:24 a.m. ET

Global macros

Although US steel producers U.S. Steel Corporation (X), AK Steel (AKS), and Steel Dynamics (STLD) have trade protections in the form of the Section 232 tariffs, the global steel pricing environment still affects US steel prices.

In this article, we’ll look at the outlook for global and Chinese steel prices.

Chinese steel prices

Although Chinese steel demand is widely expected to grow at a slower pace this year compared to last year, the country’s supply-side reforms are supporting prices. Rebar (reinforcing bar) prices in China are near a seven-year high on supply curbs. Nucor (NUE) is the largest rebar producer in North America.

Despite base metals coming under pressure from the US-China trade war, Chinese steel prices have shown resilience. Even steelmaking raw materials such as seaborne iron ore (CLF) have held their ground. Steel scrap prices have shown some weakness recently, but that could be attributed to the economic crisis in Turkey, the world’s largest scrap importer.

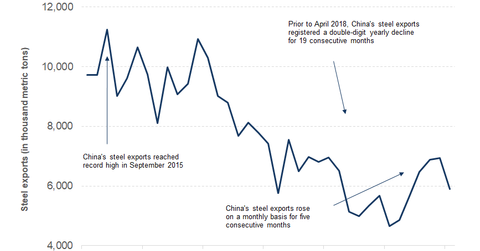

Chinese exports

As Chinese steel exports have remained in check this year, global steel prices have also been largely stable. Several regions are planning to enforce measures against Chinese steel products to prevent import deflection following the Section 232 tariffs in the United States. To sum it up, despite the trade war noise, global macros look largely stable as far as the steel industry is concerned.

Meanwhile, the concern for US steel mills is the high spread between the US and international steel prices. In the next article, we’ll discuss how long US steel producers can maintain these spreads.