Analyzing Verizon’s Revenue Trend

In fiscal 2018, Verizon Communications’ (VZ) total operating revenues rose ~3.8% YoY to $130.9 billion from $126 billion in fiscal 2017.

March 22 2019, Published 11:31 a.m. ET

Verizon’s revenue trend

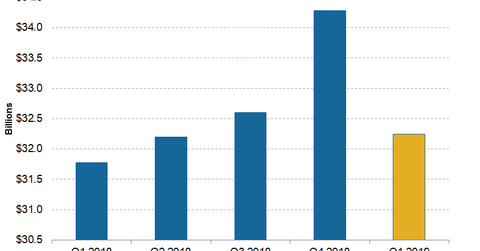

In fiscal 2018, Verizon Communications’ (VZ) total operating revenues rose ~3.8% YoY (year-over-year) to $130.9 billion from $126 billion in fiscal 2017. In the fourth quarter of 2018, the company’s total operating revenues rose ~1.0% YoY to $34.3 billion from $34 billion in the fourth quarter of 2017. The company’s wireless revenues rose ~2.7% YoY to $24.4 billion in the fourth quarter of 2018. The wireline division’s revenues fell ~3.2% YoY to $7.4 billion.

Analysts expect Verizon to generate total operating revenues of $32.2 billion in the first quarter of fiscal 2019, which represents ~1.5% YoY growth. Analysts expect Verizon to report total operating revenues of $132.1 billion for fiscal 2019, which represents ~1.0% YoY growth.