Comparing Netflix’s Valuation Metrics with Its Peers

Netflix’s stock price closed at $183.60 on July 18. The company had a market capitalization of $79.4 billion on July 18 with an enterprise value of $81.8 billion.

July 25 2017, Updated 7:36 a.m. ET

Netflix’s valuation metrics

Netflix’s stock price closed at $183.60 on July 18. The company had a market capitalization of $79.4 billion on July 18 with an enterprise value of $81.8 billion. Currently, Netflix is trading at a very high PE (price-to-earnings) multiple of 240.8x. In contrast, its peers 21st Century Fox (FOXA), Time Warner (TWX), and CBS (CBS) are currently trading at PE multiples of 16.6x, 18.7x, and 18.2x, respectively.

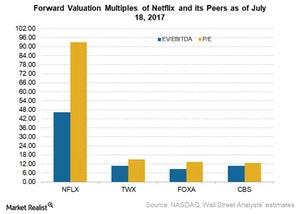

Now let’s look at Netflix’s valuation metrics, which include price-based and earnings-based multiples. Netflix has a forward price-to-earnings multiple of 92.8x and a forward EV-to-EBITDA (enterprise value-to-earnings before interest, taxes, depreciation, and amortization) of 46.2x.

Netflix’s peers 21st Century Fox, Time Warner, and CBS have forward PE multiples of 13.4x, 15.1x, and 12.5x, respectively. Netflix looks overvalued compared to peers on a forward PE basis.

Netflix’s value proposition

Netflix has already crossed the 100 million subscriber mark with its fiscal 2Q17 results. The company is also doing exceedingly well internationally, and it expects a contribution profit of $30 million in fiscal 3Q17. A major reason for Netflix’s success in the United States and internationally is its content.

The company is investing heavily in its content and streaming a mix of English-language and local content in international markets.

As a result, Netflix’s investors and analysts remain bullish about the company.