Schlumberger’s Stock Price Forecast this Week

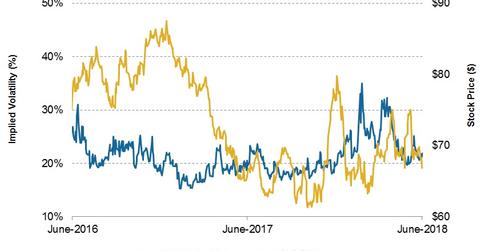

Schlumberger’s (SLB) first-quarter financial results were released on April 20. Between April 20 and June 15, Schlumberger’s implied volatility fell from 24.1% to 22%.

June 18 2018, Updated 6:00 p.m. ET

Schlumberger’s implied volatility

Schlumberger’s stock price forecast this week

Schlumberger stock will likely close between $68.86 and $64.80 by June 22, based on its implied volatility. The forecast considers a normal distribution of stock prices and one standard deviation probability of 68.2%. Schlumberger’s stock price closed at $66.83 as of June 15.

Implied volatility for Schlumberger’s peers

National Oilwell Varco’s (NOV) implied volatility as of June 15 was 26.2%, which implies a stock price of $42.99–$39.97 by June 22.

Helmerich & Payne’s (HP) implied volatility as of June 15 was 30.0%, which implies a stock price of $65.84–$60.58 by June 22.

McDermott International’s (MDR) implied volatility as of June 15 was 36.2%, which implies a stock price of $21.33–$19.29 by June 22.

Crude oil’s implied volatility

Between April 20 and June 15, crude oil’s implied volatility increased from 24.7% to 24.9%, while Schlumberger’s implied volatility fell.

Next in this series, we’ll discuss Schlumberger’s correlation coefficient with crude oil.