What’s T-Mobile’s Distribution Strategy for the Rest of 2018?

T-Mobile (TMUS), the fastest-growing and third-largest wireless service provider in the US, is expanding its distribution footprint as a means to drive growth in the untapped US markets.

Nov. 20 2020, Updated 4:32 p.m. ET

T-Mobile’s distribution strategy

T-Mobile (TMUS), the fastest-growing and third-largest wireless service provider in the US, is expanding its distribution footprint as a means to drive growth in the untapped US markets. The company opened nearly 1,500 new T-Mobile stores and over 1,300 new MetroPCS stores in 2017. T-Mobile’s management noted, “Last year, our distribution expansion was 1/3 urban, 1/3 suburban and about 1/3 new greenfield markets. This year, all of our distribution expansion is new greenfield markets.”

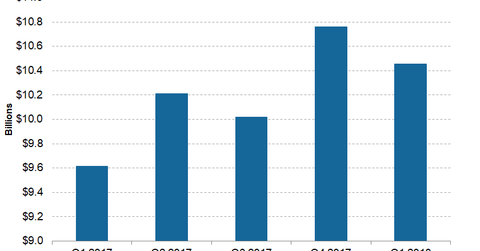

T-Mobile’s revenue trend

T-Mobile believes that the expansion of its distribution footprint could help fetch new subscribers and subsequently boost the company’s total revenue. In Q1 2018, T-Mobile reported total revenue of $10.5 billion as compared to $9.6 billion in Q1 2017.

By comparison, in Q1 2018, Verizon’s (VZ) wireless revenue rose ~4.9% year-over-year (or YoY) to reach $21.9 billion. Meanwhile, AT&T’s (T) wireless revenue from its combined domestic operations rose ~1.5% YoY to reach $17.4 billion. During the same quarter, Sprint’s (S) revenue from the wireless component fell ~4.6% YoY to reach $7.8 billion.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!