US Dollar Index and Treasury Yields Are Stable in the Early Hours

After gaining for three trading weeks, the US Dollar Index started this week on a weaker note and fell in the first four trading days of the week.

Dec. 22 2017, Published 8:29 a.m. ET

US Dollar Index

After gaining for three consecutive trading weeks, the US Dollar Index started this week on a weaker note and fell in the first four trading days of the week. On Friday, the US Dollar Index opened the day higher and traded near the opening prices in the early hours.

Market sentiment

The sentiment is weak in the US Dollar Index despite progress in the tax reform bill. There are concerns about how the tax reform bill will impact future interest rate hikes. The strong euro also limited the US Dollar Index’s upward movement. On Thursday, the dollar regained some stability. However, it closed the day lower due to a downward revision of the third quarter US GDP growth from 3.3% to 3.2%. On Friday, the US Dollar Index is stable due to a fall in the euro amid the Catalan vote that triggered political uncertainty in Spain.

The market is looking forward to the release of durable goods orders, personal spending, and new home sales on Friday. At 6:35 AM EST on December 22, the US Dollar Index was trading at 93.36—a rise of 0.09%.

US Treasury yields

US Treasury yields started this week stronger and gained in the first three trading days this week. However, Teasury yields pulled back on Thursday amid the downward revision of US third quarter GDP growth and opened Friday on a mixed note.

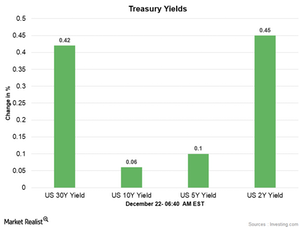

Below are the movements in Treasury yields as of 4:25 AM EST on December 20:

- The ten-year Treasury yield was trading at 2.485—a rise of ~0.06%.

- The 30-year Treasury yield was trading at 2.846—a rise of ~0.42%.

- The five-year Treasury yield was trading at 2.247—a rise of ~0.1%.

- The two-year Treasury yield was trading at 1.887—a rise of ~0.45%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.58%. The ProShares UltraPro Short 20+ Year Treasury (TTT) fell 1.8% and the ProShares UltraShort 20+ Year Treasury (TBT) fell 1.2% on December 21.

Next, we’ll discuss how commodities performed in the early hours on December 22.