Where Are We Now?

We conclude by estimating the extent to which asset owners in the U.S. market have adopted passive management.

April 20 2018, Updated 9:53 a.m. ET

We conclude by estimating the extent to which asset owners in the U.S. market have adopted passive management. Understanding the market share of passive assets requires us to get both the numerator (passive AUM) and denominator (total market capitalization) correct, and much press commentary is mistaken about one or both. Moreover, since data on exchange-traded funds are relatively easy to come by, other pools of assets are sometimes ignored. For example, a common misconception is that the Bank of Japan (BoJ) owns more than two-thirds of the Japanese stock market. In fact, the BoJ owns 70% of listed ETFs, and only 2.5% of the capitalization of the market.27

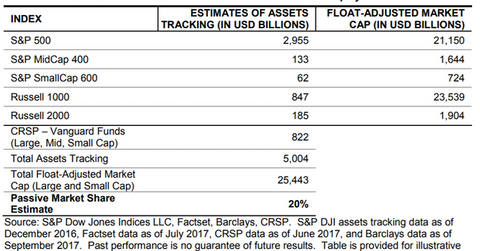

We estimate that 20% of total float-adjusted U.S. market capitalization is held by passive index trackers. As detailed by Exhibit 8, this estimate includes assets tracking our own indices, as well as those of some prominent competitors. For S&P DJI indices, estimates are drawn from our annual survey of indexed assets.28 Information on other index providers came from sell-side sources29 as well as from their own websites. The denominator includes the total float-weighted market capitalization of the large- and small-cap universe. Importantly, this estimate excludes the factor indices that underlie “smart beta” ETFs. This exclusion makes sense because factor indices represent a hybrid of passive and active approaches. They are based on fundamental metrics like value or momentum, seeking much the same end, although by different means, as active managers. Hence it is appropriate to exclude them from an estimate of purely passive assets.

Exhibit 8 tells us that approximately USD 5 trillion tracks various U.S. capweighted indices, with USD 3 trillion tracking the S&P 500 alone. These numbers enable us to estimate one benefit of passive management to investors. We previously noted the roughly 70 bps fee differential that separates active and passive U.S. mutual fund managers.30 Multiplying this fee differential by USD 3 trillion tells us that passive management, for the S&P 500 alone, saves investors USD 22.5 billion annually.

It would, of course, be penny wise and pound foolish for investors to save a few basis points on management fees if those savings caused them to miss an even larger increment of active performance, but as we’ve already seen, it isn’t because they don’t. These savings accrue entirely to the benefit of index fund investors.

FINAL THOUGHTS

Fifty years ago, there were no index funds. Edward Johnson of Fidelity spoke for most active managers of that time when he said (criticizing the nascent Vanguard), “I can’t believe that the great mass of investors are going to be satisfied with receiving just average returns.”31 Ironically, of course, above-average returns are exactly what index investors have received—and what most active investors have missed.

If active managers had delivered above-average performance, the passive investment industry would not have developed and would not exist today. Evidence of active underperformance is nearly a century old, and we’ve suggested some of the reasons—cost, professionalization, market efficiency, and skewness—that help explain it.

Index-tracking assets, conservatively reckoned, amount to perhaps 20% of the value of the U.S. stock market today, and their growth shows no sign of abating. Even at today’s share of assets, there has been an enormous transfer of wealth from active managers to asset owners—a transfer amounting to over USD 20 billion annually.

27. Takeo, Yuko, Lee, Min Jeong, and Toshiro Hasegawa, “Japan’s Central Bank Is Distorting the Market, Bourse Chief Says,” July 19, 2017. See also Ganti, Anu, “Don’t Shoot the Messenger,” Sept. 27, 2017.

28. S&P Dow Jones Indices, “Annual Survey of Assets,” June 29, 2017.

29. U.S. Index Corporate Action Calendar: Week of Sept. 4-Sept. 7, 2017, Barclays Desk Analysts and Trading, September 2017.

30. Collins and Duvall, op. cit., p. 1.

31. Swedroe, Larry, “Passive Investing Won’t Break Market,” Sept. 6, 2016.