Why Juniper Networks Expects Revenue Growth in Fiscal 2017

Juniper reported revenue of $1.4 billion in 4Q16, a rise of 5.0% YoY and 8.0% QoQ. Non-GAAP net income rose 3.0% YoY and 15.0% QoQ.

March 20 2017, Published 11:54 a.m. ET

Broad portfolio of products

Juniper Networks (JNPR) is a hardware company that delivers secure networks to several business verticals, including telecommunication companies, cloud and cable providers, financial services, and government. Juniper has three major business segments: Routing, Switching, and Network Security. The company expects network automation and its transition to cloud to drive revenue growth in the long term.

During Juniper’s 4Q16 earnings call, CEO (chief executive officer) Rami Rahim said, “We entered 2017 with an outstanding product portfolio and a determination to enable our customers to fuel their cloud businesses or to successfully migrate to cloud architectures.”

Juniper’s performance in fiscal 4Q16 and fiscal 2016

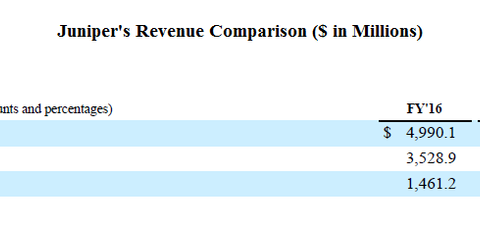

Juniper reported revenue of $1.4 billion in 4Q16, a rise of 5.0% YoY (year-over-year) and 8.0% QoQ (quarter-over-quarter). Non-GAAP (generally accepted accounting principles) net income rose 3.0% YoY and 15.0% QoQ to $254.3 million. Non-GAAP EPS (earnings per share) was $0.66. In fiscal 2016, Juniper’s revenue rose 3.0% YoY to ~$5.0 billion.

Analysts estimated that Juniper would have revenues of $1.36 billion for the quarter ended December 2016, with a low estimate of $1.34 billion and a high estimate of $1.37 billion. EPS was estimated at $0.63, with a high estimate of $0.66 and a low estimate of $0.58.

Juniper Networks has a market capitalization of $10.9 billion. In comparison, peer companies Cisco (CSCO), Fortinet (FTNT), and Europe’s (FEP) Ericsson (ERIC) have market caps of $171.0 billion, $6.0 billion, and $21.0 billion, respectively.