Comparing the Auto Industry’s Valuation Multiples

Valuation multiples are often used by investors to compare auto companies similar in size or business nature.

June 13 2018, Updated 7:30 a.m. ET

The auto industry’s valuation multiples

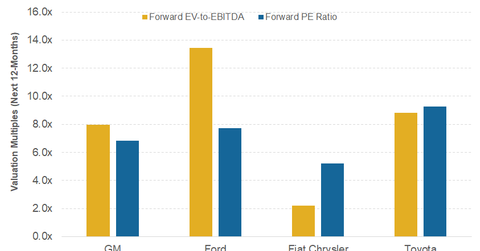

Valuation multiples are often used by investors to compare auto companies similar in size or business nature. Let’s compare valuation multiples for mainstream auto companies Ford (F), Toyota (TM), General Motors (GM), and Fiat Chrysler (FCAU).

Valuation multiples this month

Ford’s forward EV[1.enterprise value]-to-EBITDA multiple is 13.4x, much higher than home market competitor GM’s 8.0x and Japanese peer Toyota’s 8.8x. Likewise, Ford’s forward PE multiple is 7.7x, higher than GM’s 6.8x but lower than Toyota’s 9.3x.

Among the auto giants we’re covering, Fiat Chrysler has the lowest forward EV-to-EBITDA and PE multiples, of 2.2x and 5.2x, respectively, possibly due to its higher leverage increasing its risk profile.

Possible causes

After recording record numbers in 2015 and 2016, US auto sales (IYK) softened in 2017, fueling concerns about auto companies’ near-term growth. However, higher demand for pickup trucks and SUVs could be keeping optimism alive.

In the second quarter, weak US auto demand could impact auto investor sentiment and drive auto industry players’ earnings estimates downward, hurting automakers’ valuation. Continue to the next part, where we’ll look at auto part companies’ stock prices.