A Look at the Financials Sector’s Dividend Yield: Part One

Financials and basic materials have dividend yields of 2.5% and 2.4%, respectively.

Dec. 4 2020, Updated 10:43 a.m. ET

Financials and basic materials

Financials and basic materials have dividend yields of 2.5% and 2.4%, respectively.

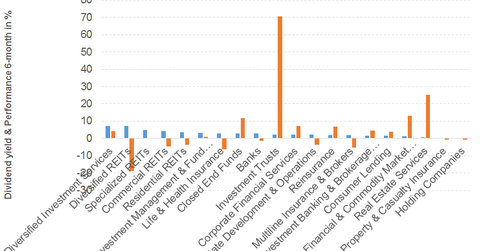

Within the financials industry, diversified investment services and diversified REITs noted the highest and second-highest dividend yields. Diversified investment services, diversified REITs, specialized REITs, commercial REITs, residential REITs, investment management and fund operators, life and health insurance, closed-end funds, and banks have beaten the broad-based indexes’ dividend yields.

Industries under this sector and the top dividend payers under the respective industries include:

- diversified investment services with a dividend yield of 7.3% and Cohen & Company (COHN)

- diversified REITs with a dividend yield of 7.1% and Colony NorthStar (CLNS)

- specialized REITs with a dividend yield of 5% and Public Storage (PSA)

- commercial REITs with a dividend yield of 4.1% and Simon Property Group (SPG)

- residential REITs with a dividend yield of 3.6% and AvalonBay Communities (AVB)

- investment management and fund operators with a dividend yield of 3.1% and the Blackstone Group (BX)

- life and health insurance with a dividend yield of 2.9% and China Life Insurance Company Limited (LFC)

- closed-end funds with a dividend yield of 2.9% and Ares Capital (ARCC)

- banks with a dividend yield of 2.8% and Bancolombia (CIB)

- investment trusts with a dividend yield of 2.3% and Compass Diversified Holdings (CODI)

- corporate financial services with a dividend yield of 2.2% and Main Street Capital (MAIN)

- real estate development and operations with a dividend yield of 2.1% and Gazit Globe (GZT)

- reinsurance with a dividend yield of 1.9% and Everest Re Group (RE)

- multiline insurance and brokers with a dividend yield of 1.9% and Brighthouse Financial (BHF)

- consumer lending with a dividend yield of 1.6% and ORIX (IX)

- investment banking and brokerage services with a dividend yield of 1.5% and Nomura Holdings (NMR)

- financial commodity market operators with a dividend yield of 1.4% and CME Group (CME)

- real estate services with a dividend yield of 0.5% and HFF (HF)

- property and casualty insurance with a dividend yield of 0.4% and CNA Financial (CNA)

- holding companies with a dividend yield of 0.4% and Jefferies Financial Group (JEF)

We’ll discuss the factors that could affect the industry going forward later in this series.