US Dollar Index and Treasury Yields Early on January 4

After falling for two consecutive trading weeks, the US Dollar Index started this week on a weaker note and traded with mixed sentiment.

Jan. 4 2018, Published 8:32 a.m. ET

US Dollar Index

After falling for two consecutive trading weeks, the US Dollar Index started this week on a weaker note and traded with mixed sentiment. After rebounding on Wednesday, the US Dollar Index opened higher on Thursday but lost strength and traded below the opening prices in the early hours.

The US Dollar Index regained strength on January 3 amid the release of December’s FOMC meeting minutes. December’s stronger-than-expected manufacturing data also added strength to the dollar. According to the Institute for Supply Management, the US ISM manufacturing purchasing managers’ index rose to 59.7 in December. It’s higher than the expected reading of 58.1. The market is looking forward to the non-farm employment change data and initial jobless claims data that are scheduled to release today.

At 5:05 AM EST on January 4, the US Dollar Index was trading at 92—a fall of 0.18%.

US Treasury yields

After falling last week, US Treasury yields regained stability this week. After a mixed start to this week, US Treasury yields fell ahead of the FOMC’s meeting minutes on January 3. In the early hours on January 4, the Treasury yields are strong and trading above the opening prices. The market is looking forward to US FOMC member Bullard’s speech at 1:30 PM EST today.

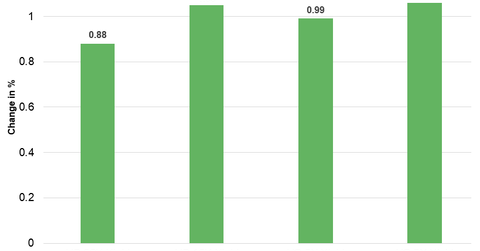

Below are the movements in Treasury yields as of 5:10 AM EST on January 4:

- The ten-year Treasury yield was trading at 2.471—a rise of ~1.05%.

- The 30-year Treasury yield was trading at 2.807—a rise of ~0.88%.

- The five-year Treasury yield was trading at 2.268—a rise of ~0.99%.

- The two-year Treasury yield was trading at 1.956—a rise of ~1.06%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.48%. The ProShares UltraPro Short 20+ Year Treasury (TTT) fell 1.4% and the ProShares UltraShort 20+ Year Treasury (TBT) fell 0.93% on January 3.

Bitcoin

After gaining more than 1,300% in the last year, bitcoin started this week on a stronger note. Bitcoin started this year on a stronger note amid the report of a $15 million–$20 million investment by PayPal co-founder Peter Thiel’s Founders Fund. Bitcoin rose to one-week high price levels on Wednesday and started Thursday on a stable note. However, it lost strength as the day progressed.

Next, we’ll discuss how commodities performed in the early hours on January 4.