How NVIDIA Plans to Improve Its Operating Efficiency

NVIDIA is increasingly investing in large market opportunities such as gaming, AV (autonomous driving), and data centers.

Nov. 20 2020, Updated 11:50 a.m. ET

NVIDIA’s operating efficiency

In the previous part of this series, we saw that NVIDIA (NVDA) has expanded its gross margin by investing in value-added platforms. The company has leveraged its platform model to maximize returns from its single GPU (graphics processing unit) architecture. Moreover, it has increased its investment in software to ~53% to leverage the architecture across various applications.

NVIDIA is increasingly investing in large market opportunities such as gaming, AV (autonomous driving), and data centers. While the company is now exploring the healthcare and manufacturing segments, they could take some time to generate earnings. Investment in fast-growing markets has accelerated its revenue growth and its platform model has reduced its operating expenses, thereby improving its operating efficiency.

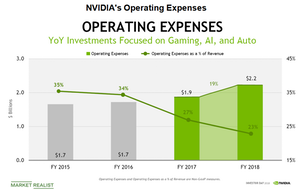

NVIDIA’s operating expenses

As shown in the above graph, NVIDIA’s non-GAAP operating expenses rose 19% YoY (year-over-year), while its revenue rose 41% YoY in fiscal 2018. Therefore, its operating expenses as a percentage of revenue fell YoY from 27% to 23%. NVIDIA’s operating expense ratio is lower than Advanced Micro Devices’ (AMD) and Intel’s (INTC) ratios of 29.6% and 29.8%. Next, we’ll look at NVIDIA’s operating efficiency in fiscal 2019.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!