A Look at Microsoft’s More Personal Computing Segment in 1Q18

More Personal Computing revenue flat Previously, we discussed Microsoft’s (MSFT) Intelligent Cloud segment’s performance. In this part, we’ll look at how its MPC (More Personal Computing) segment performed in fiscal 1Q18. Microsoft’s MPC segment, as the name suggests, is highly dependent on the PC (personal computer) market, drawing close to ~50% of its total revenue […]

Aug. 21 2020, Updated 8:50 a.m. ET

More Personal Computing revenue flat

Previously, we discussed Microsoft’s (MSFT) Intelligent Cloud segment’s performance. In this part, we’ll look at how its MPC (More Personal Computing) segment performed in fiscal 1Q18.

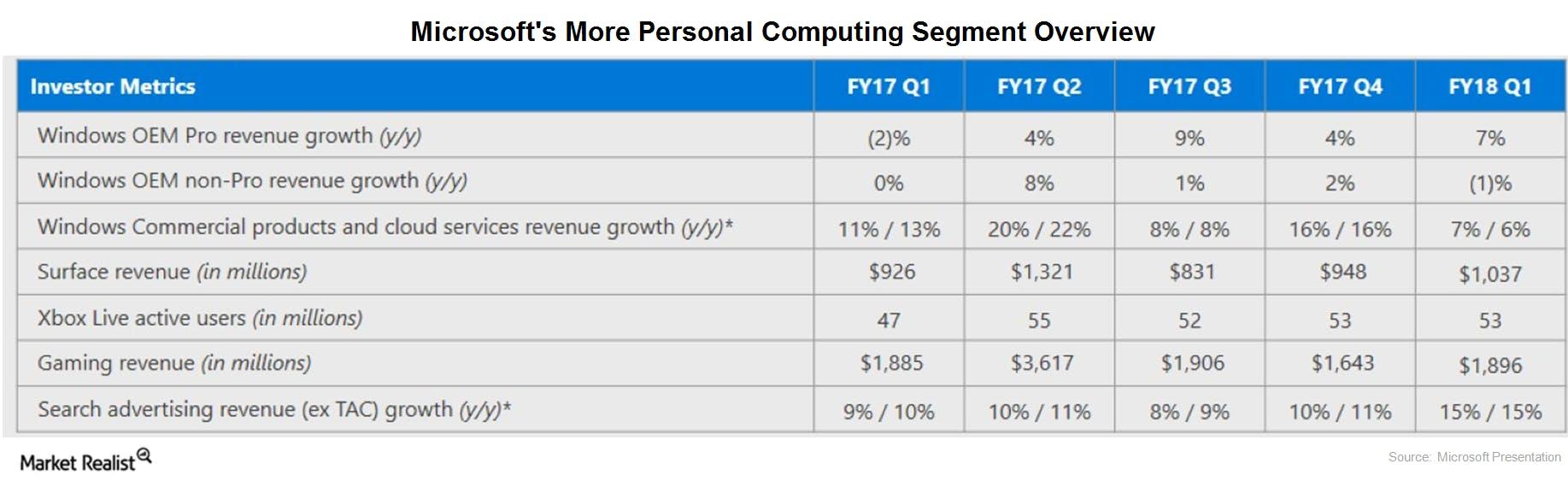

Microsoft’s MPC segment, as the name suggests, is highly dependent on the PC (personal computer) market, drawing close to ~50% of its total revenue from it. Windows OS (operating system) licensing, hardware, and devices including Surface, Lumia, and HoloLens products, Windows phones, and gaming products such as Xbox consoles are grouped under this segment.

The MPC segment’s revenue was almost flat at $9.4 billion in fiscal 1Q18. In constant-currency terms, its revenue fell 1%. As expected, sluggishness in the PC market impacted the MPC segment. Earlier this month, IDC reported that global PC shipments fell 0.5% in calendar 3Q17. The MPC segment’s revenue beat analysts’ expectation of $8.8 billion.

Outperforms overall PC market

Windows OEM (original equipment manufacturer) licenses, which are sold to companies such as Lenovo (LNVGY), HP (HP), and Dell, grew 4%, outperforming the overall PC market. Annuity revenue growth enabled Windows commercial products and cloud services to grow 7% in constant-currency terms.

In fiscal 1Q18, Microsoft introduced Windows 10 S, a new version of Windows designed for classrooms. It allows users to augment 3D objects “to develop a vibrant ecosystem with partners like Acer, ASUS, Dell, Fujitsu, HP, Samsung, and Toshiba to introduce a new class of modern devices that enable affordable, powerful new scenarios from Windows ink to 3D.” The 3D feature enables users to create and view 3D content on their PC screens.