Hormel Foods’ Road Map for Future Growth

Hormel Foods (HRL) has established a road map to boost its financial performance in a challenging food and beverage environment.

April 10 2018, Updated 12:35 p.m. ET

Challenging food and beverage environment

Hormel Foods (HRL) has established a road map to boost its financial performance in a challenging food and beverage environment. The food and beverage space is being negatively impacted by inflation in commodity prices, a consumer preference shift to organic and healthy foods, and the rise of private label products.

Increasing costs and stiffening competition are weighing on the bottom lines of major food retailers, including Hormel Foods, Conagra Brands (CAG), and the Campbell Soup Company (CPB).

2020 goals

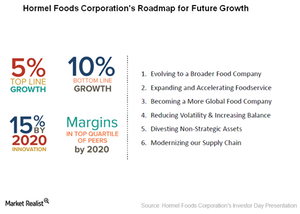

To combat industry-wide challenges, Hormel laid down a strategic road map for the future at its Investors Day in 2017. The company expects to achieve rises of 5% and 10% in its sales and EPS (earnings per share), respectively, by 2020.

The company is also working on driving sales from innovative products that have been launched in the last five years to 15% of overall sales by 2020. The company is focused on product innovation to meet changing consumer preferences, which are now shifting toward healthier and on-the-go options.

The company expects to drive growth through six outlined strategies. These include evolving into a broader food company, expanding and accelerating its food services, becoming a global food company, reducing volatility and increasing balance, selling nonstrategic assets, and streamlining and upgrading the supply chain.

Update on strategic initiatives

The company has been laser-focused on making strategic acquisitions in order to become a more diversified food company. In 2017, the company acquired Columbus Craft Meats, Fontanini, and Ceratti for ~$1.4 billion. The Columbus Crafts acquisition is important as the company looks to grow in the deli market, which is emerging as a lucrative business option. The company has a created a new deli division within its Refrigerated Products segment by integrating various deli businesses.

The company has also made strategic investments in China to boost its international expansion. With Cerrati, the company looks to expand its presence in Brazil.

In November 2017, the company also merged its Specialty Foods segment into its Grocery Products segment for efficient management and to attain cost and revenue synergies.

The company has been rationalizing its supply chain to cut down on costs, and it’s deployed zero-based budgeting to its supply chain. In 2018, the company will also be ramping up its advertising expenses by 20% compared to 2017.

In the next article, we’ll discuss Hormel Foods’ focus on the deli business.