How Will the New Fox Look after the Disney Deal?

21st Century Fox (FOXA) will be left with news and sports assets after selling most of its assets to the Walt Disney Company (DIS) in a $52.4 billion deal.

March 7 2018, Updated 10:30 a.m. ET

Fox to spin off assets

21st Century Fox (FOXA) will be left with news and sports assets after selling most of its assets to the Walt Disney Company (DIS) in a $52.4 billion deal.

As per the agreement, Disney will purchase Fox’s film and TV production businesses as well as some media and entertainment assets.

New Fox in the making

Just before the acquisition, Fox plans to spin off its Fox Broadcasting Company, Fox Sports, Fox Television Stations Group, Fox News, Fox Business Network, and sports cable networks FS1, FS2, Fox Deportes, and Big Ten Network to form a new Fox.

Additionally, the company’s studio lot in Los Angeles and equity investment in Roku will make up part of the new company. It will also possess the long-term rights to sports events including NASCAR (National Association for Stock Car Auto Racing) races and NFL (National Football League), MLB (Major League Baseball), and FIFA (Fédération Internationale de Football Association) World Cup soccer games. The new Fox will own 25% of the combined entity.

Focus shifts to advertising sales and television programming fees

Following the deal, Fox will generate revenue from advertising sales and television programming fees, as the focus will shift to live news and sports brands. Fox is expected to gain from a higher affiliate rate, a rise in retransmission fees, and robust advertising demand for its live content and entertainment products. Further, the new Fox will have sufficient cash flow generation, which will facilitate dividends.

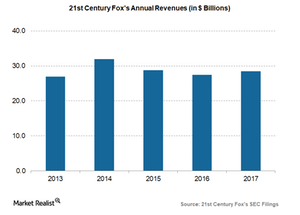

After the Disney deal, Fox is expected to generate roughly $10 billion in annual revenue. As we can see in the chart above, the original Fox made $28.5 billion in revenue in fiscal 2017.

In 2013, Fox separated its publishing company, News Corporation (NWSA), which operates newspapers such as the Wall Street Journal and London-based The Times.