How Does Micron Look to Tap Secular Memory Demand Trends?

Memory demand is becoming more secular, growing beyond PCs and into the data center, autonomous cars, IoT, and AI spaces.

March 29 2018, Updated 3:15 p.m. ET

Micron well positioned to tap secular demand

Memory demand is becoming more secular, growing beyond PCs (personal computer) and into the data center, autonomous cars, IoT (Internet of Things), and AI (artificial intelligence) spaces. Micron Technology (MU) is uniquely placed to tap this opportunity by leveraging its broad memory portfolio of advanced DRAM (dynamic random-access memory), NAND (negative-AND), NOR Flash, and 3D XPoint technologies. Its broad memory portfolio helped it achieve record design wins in the automotive space in its fiscal 1H18, which ended on March 1, 2018.

In the NAND space, Micron’s management is focusing on delivering high-value solutions. In the DRAM space, it’s investing in technology advancements to achieve cost competitiveness with Samsung (SSNLF) and SK Hynix.

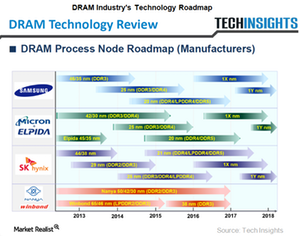

Technology roadmap

In the DRAM space, Micron is ramping up DRAM production on the 1X node, which it plans to complete by 1H19. Meanwhile, the company is developing a 1Y node and plans to bring it online at the end of 2018. On the company’s fiscal 2Q18 earnings call, CEO Sanjay Mehrotra was asked what would come after 1Y. He stated that the company was working on 1Z technology and would look for opportunities for further scaling.

In the NAND space, Micron has ended its partnership with Intel (INTC). This partnership was set to last until third-generation 3D NAND. Micron expects to start sampling its 1Y DRAM and third-generation 3D NAND by August 2018 and to ramp up the initial production of these new nodes in 2H18.

Micron has started research work on fourth-generation 3D NAND without Intel, increasing its research costs.

Next, let’s look at Micron’s product strategy.