H.B. Fuller Increases Price for Adhesives in North America

On March 3, 2017, H.B. Fuller (FUL) announced price increases for its adhesives in the North American region.

March 6 2017, Published 9:16 a.m. ET

H.B. Fuller increases adhesives price

On March 3, 2017, H.B. Fuller (FUL) announced price increases for its adhesives in the North American region. The price increase will be in the range of 5% to 8%. The price increase will be effective from April 1, 2017, or as the contract allows. The prices were increased primarily due to recent cost changes and supply constraints to feedstocks such as propylene, ethylene, methanol, butadiene, isoprene, and acetone, which have led to higher raw material costs.

In 2016, 38% of H.B. Fuller’s total revenue of $2.1 billion came from the Americas Adhesives segment. The impact of the price increase could be seen beginning in 2Q17.

H.B. Fuller’s stock price

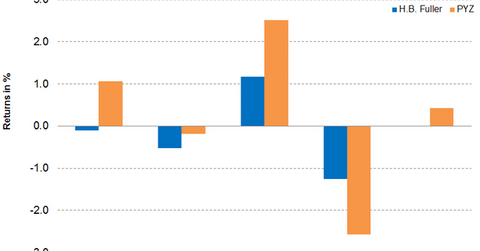

On March 3, 2017, FUL closed at $49.36, dropping 0.7% for the week. FUL stock price traded 3.5% above its 100-day moving average price of $47.68, indicating an upward trend in the stock. Analysts expect FUL’s 12-month target price to be at $50.25, implying a potential return of 1.8% over the closing price on March 3. Year-to-date, the stock returned 2.2%.

The 14-day relative strength index (or RSI) of 49 indicates that the stock is neither overbought nor oversold. An RSI of 70 and above indicates that the stock is overbought, while an RSI of 30 and below indicates that the stock is oversold.

The PowerShares DWA Basic Materials Momentum Portfolio ETF (PYZ), which holds 1.9% in FUL as of March 3, outperformed FUL, which rose 1.2% for the week to close at $63.17. The top holdings of the fund include Chemours (CC), Cliffs Natural Resources (CLF), and Avery Dennison (AVY), which have weights of 4.9%, 3.9%, and 3.6%, respectively.