Key Events That Could Steer Oil and Gas Prices This Week

The EIA’s (U.S. Energy Information Administration) Drilling Productivity Report is scheduled for release on February 12, 2018.

Feb. 12 2018, Updated 2:25 p.m. ET

Important events

The EIA’s (U.S. Energy Information Administration) Drilling Productivity Report is scheduled for release on February 12, 2018. The report could add bearishness to US crude oil and natural gas prices if it indicates an increase in oil and natural gas production in the major shale regions.

The United States 12 Month Oil ETF (USL) and the ProShares Ultra Bloomberg Crude Oil ETF (UCO), which track US crude oil futures, could be affected by oil’s fluctuations. In fact, these ETFs fell 8.1% and 17.5%, respectively, given the 9.5% fall in US crude oil futures last week. We discussed these oil-tracking ETFs in detail in Part Five of this series.

The IEA’s (International Energy Agency) Oil Market Report could also be important for global oil prices.

The EIA’s oil inventory and oil production data could be important for oil prices. The same is also true for natural gas prices after the EIA reports the natural gas inventory figure on February 15, 2018.

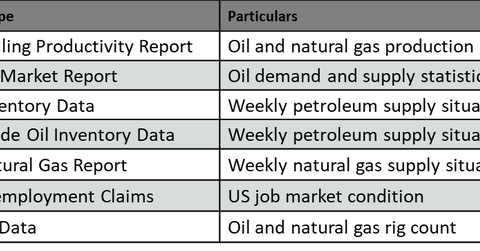

The table above provides a calendar of important events that will drive oil and gas prices in this week.