How Are Negative Interest Rates Affecting Gold?

Negative interest rates around the globe, along with overall economic concerns, are adding to the unrest in the Market.

June 13 2016, Published 7:46 a.m. ET

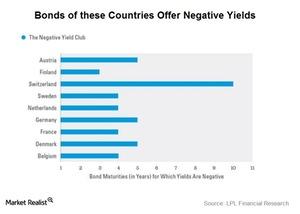

Negative interest rate club

Negative interest rates around the globe, along with overall economic concerns, are adding to the unrest in the Market. The ECB (European Central Bank), led by Mario Draghi, plunged into the corporate bond market and bought the debt of some of the continent’s biggest companies. As much as 40% of securities in the Bloomberg Eurozone Sovereign Bond Index offered a negative yield.

Gold had its best start in almost three decades as global unrest gripped investors with fear. The negative interest rates in the leading economies of Japan and Europe also gave a boost to non-yield–bearing gold. Investors would rather park their money in the precious metals and precious metal–based funds than pay a yield for their investments. Also, the precious metals are famous for their safe-haven appeal and provide security during uncertain times.

Different scenarios affecting gold

Gold may likely get some support with negative interest rates, especially in the Eurozone. A similar move can be observed in the funds that track gold and other precious metals. Funds like the DB Gold Double Long ETN (DGP) and VanEck Merk Gold Trust (OUNZ) have risen 37.2% and 17.3%, respectively, on a YTD (year-to-date) basis, as of June 9. Silver-based funds like the ETRACS CMCI Silver Total Return ETN (USV) and the PowerShares DB Silver Fund (DBS) have risen 15.6% and 18.8%, respectively, on a YTD basis.

The scenario in the Eurozone is opposite to that of the United States. Fear of an interest rate hike in the United States pushes gold lower, whereas the easing of monetary policy in the Eurozone gives buoyancy to the precious metals.

In the final part of this series, we’ll look at how China’s investment in gold is affecting the precious metal’s price movement.