Celanese Increases Prices of Ethyl Acetate in the Americas

On October 22, Celanese (CE) announced that it would be increasing the prices of ethyl acetate in the Americas region.

Oct. 29 2018, Updated 11:35 a.m. ET

Update on Celanese product price increase

On October 22, Celanese (CE) announced that it would be increasing the prices of ethyl acetate in the Americas region. The price increase will be effective from November 1 or as the contract allows. Celanese did not specify any reason for the price increase. Its effects will be seen across the United States, Canada, Mexico, and South America. Below are the details of the price increase:

- Ethyl acetate’s price will be increased by $0.03 per pound in the United States and Canada.

- In Mexico and South America, ethyl acetate’s price will be increased by $65 per metric ton.

The increase in ethyl acetate’s price could have a positive impact on CE’s revenue, which will likely be visible in the fourth quarter. Celanese, which announced its third-quarter earnings results on October 18, reported revenue of $1.77 billion in the quarter, a rise of 13.1% over the previous year.

Stock price update

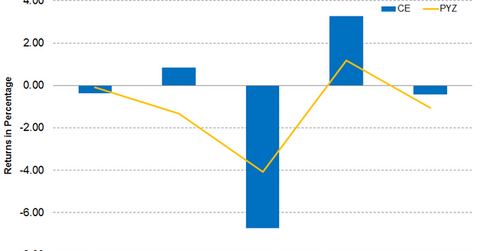

The continued weakness in the US market sent Celanese stock down 3.6% last week. The stock closed at $95.99 on October 26. As a result, Celanese stock was trading 14.4% below its 100-day moving average price of $112.10. The fall in the stock extended its negative return in 2018. On a year-to-date basis, the stock has fallen 10.4%.

Eastman Chemical (EMN), LyondellBasell (LYB), and Westlake Chemical (WLK) have fallen 15.6%, 19.1%, and 33.3%, respectively. Celanese has performed better than its peers. Celanese’s 14-day relative strength index score of 33 indicates that the stock is neither overbought nor oversold.

Investors can hold Celanese indirectly through the Invesco DWA Basic Materials Momentum ETF (PYZ). PYZ had 2.9% exposure to Celanese on October 26. PYZ fell 5.3% last week.