US Dollar Index Regained Strength Early on January 16

After falling for four consecutive trading weeks, the US Dollar Index started this week on a weaker note by falling to three-year low price levels.

Jan. 16 2018, Published 7:32 a.m. ET

US Dollar Index

After falling for four consecutive trading weeks, the US Dollar Index started this week on a weaker note by falling to three-year low price levels. However, the US Dollar Index opened Tuesday on a stable note and traded with strength in the early hours.

The selling pressure in the US Dollar Index accelerated after breaking the important support level of 91.75 on January 12. Despite the release of supporting economic data like US core consumer prices and retail sales data last week, there’s still selling pressure in the US Dollar Index. The euro’s rally is one of the bearish factors for the US Dollar Index. Expectations of an interest rate hike by the Fed in March rose above 70%.

The market is looking forward to the release of January’s US NY Empire State Manufacturing Index at 8:30 AM EST today. At 5:40 AM EST on January 16, the US Dollar Index was trading at 90.53—a gain of 0.44%.

US Treasury yields

After gaining for two consecutive trading weeks, US Treasury yields started this week on a mixed note. On Tuesday, the Treasury yields lost strength and traded with weakness at one-week low price levels in the early hours. Bond prices rose because investors are looking forward to news about auctions. The yields move oppose to movements in bond prices.

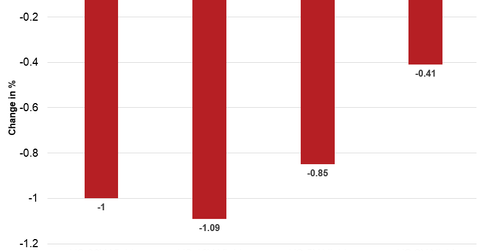

Below are the movements in Treasury yields as of 5:50 AM EST on January 16:

- The ten-year Treasury yield was trading at 2.524—a fall of ~1.1%.

- The 30-year Treasury yield was trading at 2.826—a fall of ~1%.

- The five-year Treasury yield was trading at 2.328—a fall of ~0.78%.

- The two-year Treasury yield was trading at 1.994—a fall of ~0.41%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.17%. The ProShares UltraPro Short 20+ Year Treasury (TTT) and the ProShares UltraShort 20+ Year Treasury (TBT) fell 0.54% and 0.31%, respectively, on January 12.

Bitcoin

After pulling back last week, Bitcoin started this week on a weaker note. In the early hours on Tuesday, Bitcoin is trading with weakness due to the decreased risk appetite. European regulators’ warnings about cryptocurrency along with speculations regarding a regulatory crackdown on cryptocurrencies by China are weighing on Bitcoin this week. At 5:55 AM EST, the Bitcoin-US Dollar contract was trading at $11,548.0—a fall of 16.2%.

Next, we’ll discuss how commodities performed in the early hours on January 16.