US Dollar Index and Treasury Yields Early on January 26

The US Dollar Index started this week on a weaker note. At 3:35 AM EST on January 26, the US Dollar Index was trading at 88.83—a drop of 0.62%.

Jan. 26 2018, Published 9:36 a.m. ET

US Dollar Index

The US Dollar Index declined for five consecutive trading weeks and traded at three-year low price levels last week. Carrying forward the weak sentiment, the US Dollar Index started this week on a weaker note and declined as the week progressed. After a brief rebound on Thursday, the US Dollar Index opened lower on January 26 and traded at fresh three-year low levels in the early hours.

Market sentiment

The market sentiment on the US Dollar Index was weak at the beginning of this week amid the US government shutdown. However, the end of the government shutdown didn’t boost the US Dollar Index on Tuesday. On Wednesday, the US Dollar Index declined but recovered its losses after President Trump commented that he expects the US Dollar Index to get stronger. Despite the rebound, the US Dollar Index lost strength on Friday. The market is looking forward to the release of US Q4 GDP data at 8:30 AM EST on Friday.

At 3:35 AM EST on January 26, the US Dollar Index was trading at 88.83—a drop of 0.62%.

US Treasury yields

Following a strong performance for three consecutive trading weeks, US Treasury yields started this week on a mixed note and fell as the week progressed. After declining on Thursday, Treasury yields are stable in the early hours on Friday.

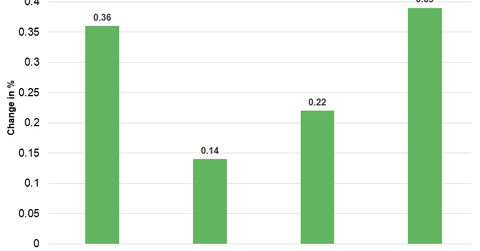

Below are the movements in Treasury yields as of 3:35 AM EST on January 26.

- The ten-year Treasury yield was trading at 2.625—a rise of ~0.14%.

- The 30-year Treasury yield was trading at 2.891—a rise of ~0.36%.

- The five-year Treasury yield was trading at 2.423—a rise of ~0.22%.

- The two-year Treasury yield was trading at 2.092—a rise of ~0.39%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.82%. The ProShares UltraPro Short 20+ Year Treasury (TTT) and the ProShares UltraShort 20+ Year Treasury (TBT) fell 2.6% and 1.6%, respectively, on January 25.

Bitcoin

Amid increased caution from investors, Bitcoin declined for two weeks and started this week on a weaker note. An increased focus on regulatory systems in Asian markets on cryptocurrency trading weighed on Bitcoin. According to recent reports, Nordea, which is a Swedish banking giant, ordered its employees not to trade cryptocurrencies. At 3:45 AM EST, the Bitcoin-US Dollar contract was trading at $10,620.0—a fall of 6.5%.

Next, we’ll discuss how commodities performed in the early hours on January 26.