Analysts’ Views of American Tower

As of January 2018, 21 of the 22 analysts covering American Tower stock have given it a “buy” or “strong buy” rating. The remaining analyst gave it a “hold” rating.

Jan. 15 2018, Updated 9:01 a.m. ET

Analyst ratings

American Tower’s (AMT) performance expectations in 2018 are reflected in its analyst ratings. Analysts have given AMT a mean price target of $162.23, implying a 16% rise from its current level of $140.51. It has a market capitalization of $60.3 billion.

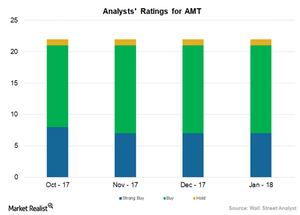

As of January 2018, 21 of the 22 analysts covering the stock have given it a “buy” or “strong buy” rating. The remaining analyst gave it a “hold” rating. Compared to October 2017, the number of AMT’s “strong buy” and “buy” ratings have been constant.

Peer ratings

Among American Tower’s major peers, Realty Income (O) has a “buy” or “strong buy” rating from four of the 19 analysts covering the stock and a “hold” rating from 12 analysts. Two analysts gave it an “underperform” rating. The target price for O is $58.56, while the current price is $55.21.

Fourteen of the 20 analysts covering SBA Communications (SBAC) have given it a “buy” or “strong buy” rating, and six analysts have given it a “hold” rating. The target price for SBAC is $173.52 from its current level of $161.75.

Thirteen of the 21 analysts covering Crown Castle International (CCI) have given it a “buy” or “strong buy” rating, and eight analysts have given it a “hold” rating. The target price for CCI is $107.21 from the current level of $115.17.

Investors looking for exposure to multi-tenant communications real estate can invest in REIT ETFs. AMT makes up 4.4% of the ProShares Ultra Real Estate (URE).