US Dollar Index is Weak in the Early Hours on December 15

The US Dollar Index traded with strength for two weeks and started this week on a mixed note amid the dented market sentiment.

Dec. 15 2017, Published 8:26 a.m. ET

US Dollar Index

The US Dollar Index traded with strength for two weeks and started this week on a mixed note amid the dented market sentiment. After a brief pullback on Thursday, the US Dollar Index opened lower on Friday and traded with weakness in the early hours.

Market sentiment

The US Dollar Index opened higher this week amid the expectation of an interest rate hike and optimism about the tax cut plan. However, the sentiment was dented amid concerns about a possible delay in the tax cut plan. Doubts about the tax cut plan increased after Senator Marco Rubio commented that he wouldn’t support the tax cut plan unless it involves child tax credits. The market is looking forward to the release of November’s industrial production data at 9:15 AM EST today.

At 6:10 AM EST on December 15, the US Dollar Index was trading at 93.44—a fall of 0.05%.

US Treasury yields

After falling to one-week low levels on Wednesday, US Treasury yields regained some stability on Thursday amid the release of upbeat US economic data. US Treasury yields opened higher on Friday and were stable in the early hours.

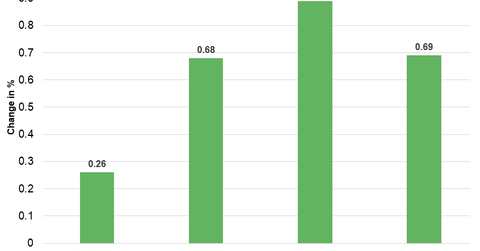

Below are the movements in Treasury yields as of 6:15 AM EST on December 15.

- The ten-year Treasury yield was trading at 2.362—a rise of ~0.68%.

- The 30-year Treasury yield was trading at 2.717—a rise of ~0.26%.

- The five-year Treasury yield was trading at 2.147—a rise of ~0.89%.

- The two-year Treasury yield was trading at 1.824—a rise of ~0.69%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.42%. The ProShares UltraPro Short 20+ Year Treasury (TTT) fell 1.3% and the ProShares UltraShort 20+ Year Treasury (TBT) fell 0.86% on December 14.

Next, we’ll discuss how commodities performed in the early hours on December 15.