US Dollar Index and Treasury Yields Are Mixed in the Early Hours

On January 24, 2018, the US Dollar Index opened the day lower and traded at fresh three-year low price levels in the early hours.

Jan. 24 2018, Published 8:11 a.m. ET

US Dollar Index

After declining for five consecutive trading weeks and falling to three-year low price levels, the US Dollar Index started this week on a weaker note and declined as the week progressed. On January 24, 2018, the US Dollar Index opened the day lower and traded at fresh three-year low price levels in the early hours.

The market sentiment is mixed to weak this week, which weighed on the US Dollar Index. The end of the US shutdown didn’t boost the US Dollar Index on Tuesday. The risk appetite declined amid speculations about trade policy and jitters in the US government. The International Monetary Fund’s upbeat outlook on global economic growth, better-than-expected corporate earnings released this week, and the new tax code didn’t add strength to the US Dollar Index.

The market is looking forward to a string of US economic data scheduled to release on Wednesday. The data include the House Price Index, manufacturing PMI, services PMI, and home sales. At 3:20 AM EST on January 24, the US Dollar Index was trading at 89.87—a drop of 0.28%.

US Treasury yields

After gaining for three consecutive trading weeks, US Treasury yields started this week on a mixed note. After a pullback on Tuesday amid an increase in bond prices, US Treasury yields are trading with strength in the early hours on Wednesday.

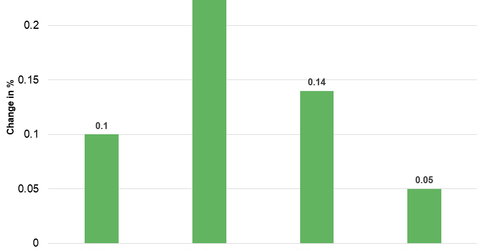

Below are the movements in Treasury yields as of 3:30 AM EST on January 24.

- The ten-year Treasury yield was trading at 2.628—a rise of ~0.23%.

- The 30-year Treasury yield was trading at 2.911—a rise of ~0.3%.

- The five-year Treasury yield was trading at 2.428—a rise of ~0.35%.

- The two-year Treasury yield was trading at 2.064—a rise of ~0.25%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.43%. The ProShares UltraPro Short 20+ Year Treasury (TTT) and the ProShares UltraShort 20+ Year Treasury (TBT) fell 1.4% and 0.86%, respectively, on January 23.

Bitcoin

Following a weak performance for two weeks, Bitcoin carried forward the weakness this week. Increasing concerns about regulatory pressures from Asian markets like China and South Korea are weighing on the cryptocurrency market. At 3:28 AM EST, the Bitcoin-US Dollar contract was trading at $10,969.0—a gain of 5.2%.

Next, we’ll discuss how commodities performed in the early hours on January 24.