After a Tough 2017, What Lies ahead for AK Steel in 2018?

While U.S. Steel shed ~26% of its market cap after its 1Q17 earnings miss, AK Steel investors were left poorer by 21% after AKS’s 3Q17 earnings miss.

Dec. 5 2017, Updated 2:48 p.m. ET

AK Steel

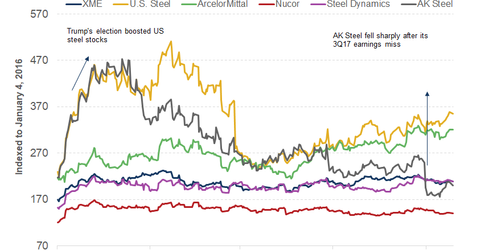

Steel stocks—or, for that matter, the entire metals and mining space—tend to be more volatile than broader markets (XME). This is not surprising, given commodities’ cyclical nature. During cyclical downturns, we usually see selling pressure among steel stocks, but as markets take a turn for the better, investors flock to metal stocks.

Within the steel space, we’ve seen some stocks become more volatile than others. In the US market, AK Steel (AKS) and U.S. Steel (X) are generally more volatile than Nucor (NUE) and Steel Dynamics (STLD). Both U.S. Steel and AK Steel more than quadrupled last year, as steel came back in favor with investors after two years of pessimism.

More recently, AKS and X saw massive selling pressure this year after their earnings releases. While U.S. Steel shed ~26% of its market capitalization after its 1Q17 earnings miss, making it the worst single-day fall for the stock, AK Steel investors were left poorer by 21% after AKS’s 3Q17 earnings miss.

Series overview

While U.S. Steel has recouped some of its 2017 losses, AK Steel is still trading with year-to-date losses of 51.4%, based on December 4 closing prices. In this series, we’ll discuss why AK Steel is more volatile than other steel stocks, assess why the stock has been weak in 2017, and analyze AK Steel’s outlook to understand how the stock could play out in 2018 after a weak 2017.

Continue to the next part (below) for a discussion as to why AK Steel stock has been so volatile.