US Dollar Index and Treasury Yields Rose in the Early Hours

After gaining for three consecutive trading weeks, the US Dollar Index started this week on a mixed note.

Dec. 18 2017, Published 7:52 a.m. ET

US Dollar Index

After gaining for three consecutive trading weeks, the US Dollar Index started this week on a mixed note. The US Dollar Index opened higher on Monday but traded below opening prices in the early hours.

Market sentiment

The market sentiment on the US Dollar Index was strong at the beginning of the week amid the focus on an interest rate hike and economic projections. The market sentiment is strong this week due to increased optimism about US tax reform plans. Caution before the Senate and House of Representative’s vote is limiting the upward movement on Monday. The market is looking forward to the release of major economic data this week like home sales data, third quarter GDP, personal spending, and jobs data.

At 4:50 AM EST on December 18, the US Dollar Index was trading at 93.69—a fall of 0.26%.

US Treasury yields

After a mixed performance last week, US Treasury yields are stable on Monday. Increased expectations about US tax reform plans are supporting Treasury yields in the early hours. The market is awaiting the US three-month and six-month bill auction at 11:30 AM EST today.

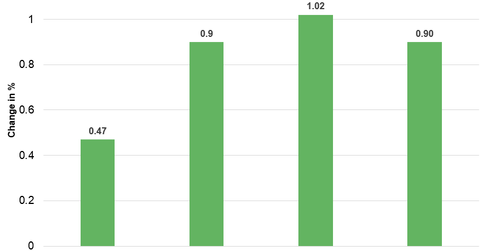

Below are the movements in Treasury yields as of 4:55 AM EST on December 18

- The ten-year Treasury yield was trading at 2.373—a rise of ~0.75%.

- The 30-year Treasury yield was trading at 2.698—a rise of ~0.33%.

- The five-year Treasury yield was trading at 2.176—a rise of ~0.87%.

- The two-year Treasury yield was trading at 1.857—a rise of ~0.9%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.38%. The ProShares UltraPro Short 20+ Year Treasury (TTT) fell 1% and the ProShares UltraShort 20+ Year Treasury (TBT) fell 0.63% on December 15.

Next, we’ll discuss how commodities performed in the early hours on December 18.