Why Industry Analysts Raised VMware’s Stock Price Target

Brad Reback, an analyst with Stifel Nicolaus, explained the factors that led his firm to raise the price target for VMware stock to $152 from $150.

Dec. 25 2017, Updated 7:31 a.m. ET

VMware’s rising price targets

So far in this series, we’ve looked at VMware’s (VMW) fiscal 3Q18 earnings and its recent acquisition of VeloCloud to move ahead in the growing SDN (software-defined networking) space. VMware’s fiscal 3Q18 earnings and its current guidance have exceeded analysts’ expectations. Its 10% revenue growth in fiscal 4Q18 is higher than analysts’ expected growth of 7%.

Market sentiment has vastly improved as VMware continues to propel itself in the cloud space. Citing FactSet data, MarketWatch reported that at least 16 analysts have raised their price targets for VMware stock after its fiscal 3Q18 earnings announcement.

Industry analysts’ view of VMware stock after fiscal 3Q18 results

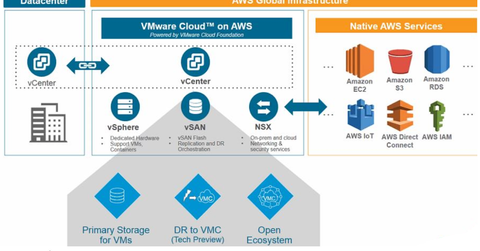

Brad Reback, an analyst with Stifel Nicolaus, explained the factors that led his firm to raise the price target for VMware stock to $152 from $150. Reback said, “Continued solid execution across products/geographies, a healthy enterprise spend environment along with continued traction with hybrid clouds and promising new products (VMware Cloud on AWS, PKS, AppDefense VeloCloud, etc.) positions VMW well for sustained growth in coming years.”

Earlier in the series, we looked at VMware’s 16% and 21% growth in license billings and total billings, respectively, in 3Q18. That could point to its services and offerings appeal.

For Ittai Kidron, an analyst with Oppenheimer, it was VMware’s hybrid cloud strategy that was the reason for optimism and a significant increase in its price target to $135 from $120. Kidron stated, “We believe continued success in hybrid cloud could drive earnings upside and potentially long-term multiple expansion.”