A Closer Look at Twitter’s Capex Priorities

Twitter expects its capex to be in the range of $60 million–$85 million in the fourth quarter of 2018.

Jan. 18 2019, Updated 7:32 a.m. ET

Fourth-quarter capex forecast

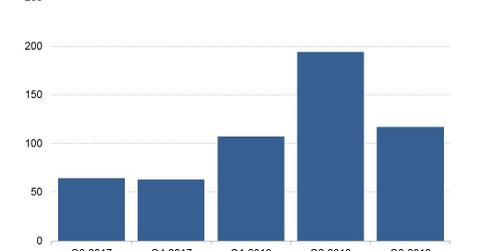

Twitter (TWTR) spent $117 million on capex in the third quarter of 2018. Alphabet (GOOGL) and Facebook (FB) reported capex of $5.3 billion and $3.3 billion, respectively, in the quarter. Baidu (BIDU) and Yandex (YNDX) reported capex of ~$200 million and $66 million, respectively, in the quarter.

Twitter’s capex was $63 million in the fourth quarter of 2017. The company expects its capex to be in the range of $60 million–$85 million in the fourth quarter of 2018, the period for which it’s preparing to release its results.

Infrastructure development drives capex

Twitter has maintained capex of over $100 million in each of the last three reported quarters. Twitter’s capex in recent quarters has been driven by investments in infrastructure developments to support what the company has described as “product priorities.”

Many Internet companies have been investing in data center developments recently to meet their growing data storage and computing needs, in turn driving up their capex. Facebook, for instance, is developing its first Asian data center in Singapore at a cost of $1.0 billion. Google has been developing data centers to support its cloud computing operations. Twitter operates its own data centers, but it also hosts some of its data on Google’s cloud platform.