How AstraZeneca’s Nexium, Synagis, and Losec Have Performed in 2017

In 3Q17, AstraZeneca’s (AZN) Nexium generated revenues of $469.0 million, which reflected an ~9.0% decline on a year-over-year basis.

Dec. 22 2017, Updated 10:30 a.m. ET

Nexium’s revenue trends

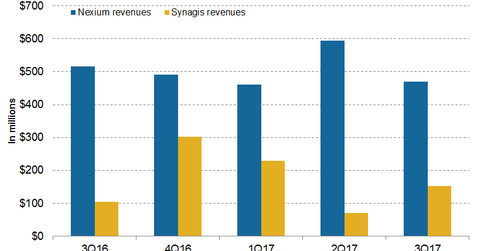

In 3Q17, AstraZeneca’s (AZN) Nexium generated revenues of $469.0 million, which reflected an ~9.0% decline on a year-over-year (or YoY) basis and a 21.0% decline on a quarter-over-quarter basis. Nexium reported 9M17 revenues of $1.5 billion, which reflected an ~1.0% decline on a YoY basis.

Nexium (esomeprazole magnesium) is used for the treatment of acid reflux disease. Nexium is typically used in patients who experience heartburn two or more days per week despite treatment and a change of diet.

Synagis’s revenue trends

In 3Q17, Synagis generated revenues of $153.0 million, which reflected ~47.0% growth on a YoY basis. Synagis reported 9M17 revenues of $453.0 million, which represents 21.0% growth on a YoY basis.

Synagis (palivizumab) is an RSV (respiratory syncytial virus) F protein inhibitor monoclonal antibody used as a prophylaxis against serious lower respiratory tract disease.

This condition can be caused by RSV in pediatric patients with a history of premature birth. It can also be found in pediatric patients with bronchopulmonary dysplasia or with hemodynamically significant congenital heart disease.

Losec’s revenue trends

Losec (omeprazole) is a proton pump inhibitor used for prevention of acidity in the stomach. In 3Q17, Losec generated revenues of $66.0 million, which is an ~8% decline on a YoY basis and a 3.0% decline quarter-over-quarter. Losec reported 9M17 revenues of $202.0 million, which is an ~7.0% decline on a YoY basis.

AstraZeneca’s Nexium and Losec compete with Takeda Pharmaceuticals’ (TKPYY) Dexilant, Pfizer’s (PFE) Protonix, and GlaxoSmithKline’s (GSK) Prevacid. The BLDRS Developed Markets 100 ADR Index ETF (ADRD) invests ~2.0% of its total portfolio in AstraZeneca.