JCPenney’s Sales Growth Strategy

JCPenney (JCP) has been undertaking several strategic actions to improve its sales amid a challenging retail environment.

Dec. 21 2017, Updated 5:20 p.m. ET

Efforts to revive sales

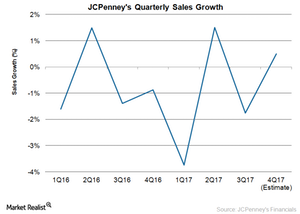

JCPenney (JCP) has been undertaking several strategic actions to improve its sales amid a challenging retail environment. The company’s same-store sales grew 0.1% in fiscal 3Q17, compared to a decline of 2.7% and 0.4% in fiscal 1Q17 and fiscal 2Q17, respectively. However, the company’s overall sales fell 1.8% in fiscal 3Q17. The fall was mainly due to the impact of the 139 stores closed in the current fiscal year.

Growth strategy

JCPenney is trying to boost sales by focusing on categories like beauty, home, and toys. In the beauty business, the company has added 70 new Sephora locations and expanded 32 existing locations in fiscal 2017. JCPenney now operates about 642 Sephora locations within its stores. The company continues to enhance the product offerings in its Sephora stores with attractive additions like Fenty Beauty by Rihanna. Within its beauty business, JCPenney has also been rebranding its salons to The Salon by InStyle brand.

Within its home business, the company has appliance showrooms in about 600 stores. The company has been adding popular brands to make its home offerings interesting. In October 2017, the company added Frigidaire kitchen appliances to nearly 600 JCPenney appliance showrooms and JCPenney.com. JCPenney has also expanded its mattress showrooms to 500 stores.

JCPenney has also added new toy shops to all its stores. The company has aggressively expanded its toys and games assortment from leading brands such as Disney, Hasbro, Mattel, Lego, and Fisher Price. Toys are a major gift choice for the holiday season, which is expected to drive the company’s sales.

The company has also been undertaking several initiatives to improve its women’s apparel business. The company’s efforts include expanding its plus-size assortment and a partnership with Nike to offer enhanced assortment in more stores.

Sales expectations

Currently, analysts expect JCPenney’s 4Q17 sales to rise 0.5% to about $4.0 billion. The company’s fiscal 2017 sales are expected to fall 0.8% to $12.5 billion. Rival Kohl’s (KSS) 4Q17 sales are expected to rise 2.5% to $6.4 billion in fiscal 4Q17. Kohl’s full-year fiscal 2017 sales are expected to fall about 0.1% to $18.7 billion.

Let’s discuss JCPenney’s margins in the next part of this series.