US Dollar Index Is Weak in the Early Hours on November 27

The US Dollar Index started this week on a weaker note and traded below the opening prices in the early hours on Monday.

Nov. 27 2017, Published 8:33 a.m. ET

US Dollar Index

The US Dollar Index fell for three consecutive trading weeks amid the dented market sentiment. Carrying forward the weakness, the US Dollar Index started this week on a weaker note and traded below the opening prices in the early hours on Monday.

Market sentiment

Unwinding long positions amid political uncertainty in the US are weighing on the US Dollar Index. The lack of progress on US tax reform plans along with the decreased risk appetite is limiting the US dollar’s upward movement. The market is looking forward to the Senate’s vote on tax reform plans this week. The risk appetite is lower today. The market is looking forward to several countries’ major economic releases this week, which could impact the forex market.

At 6:05 AM EST today, the US Dollar Index is trading at 92.66—a fall of 0.13%.

US Treasury yields

US Treasury bonds are trading with a weak sentiment in the early hours on Monday. The market is looking forward to the string of US Treasury auctions today. Treasury yields, which move opposite to bond movements, are strong in the early hours.

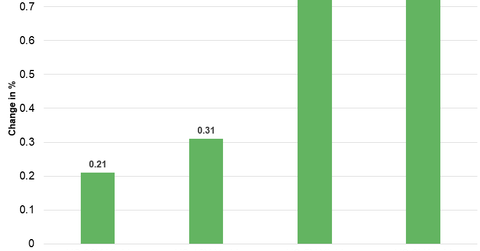

Treasuries’ performance on November 27

- ten-year Treasury yields closed at 2.347—a rise of ~0.31%

- 30-year Treasury yields closed at 2.767—a rise of ~0.21%

- five-year Treasury yields closed at 1.761—a rise of ~0.76%

- two-year Treasury yields closed at 2.080—a rise of ~0.75%

The iShares 20+ Year Treasury Bond ETF (TLT) fell 0.28%, the ProShares UltraPro Short 20+ Year Treasury ETF (TTT) rose 0.94%, and the ProShares UltraShort 20+ Year Treasury ETF (TBT) rose 0.56% on November 24.

In the next part of this series, we’ll discuss how commodities performed in the early hours on November 27.