US Dollar Index and Treasury Yields in the Early Hours

The US Dollar Index started Thursday on a mixed note and traded with weakness in the early hours.

May 10 2018, Published 8:36 a.m. ET

US Dollar Index

Following a strong performance for three consecutive trading weeks, the US Dollar Index started this week on a stronger note. The US Dollar Index gained in the first three trading days this week. The US Dollar Index started Thursday on a mixed note and traded with weakness in the early hours.

Market sentiment

The market sentiment on the US Dollar Index is stronger this week amid higher oil prices and signs of improved inflation. Higher interest rates with speculations about a faster interest rate hike pace are supporting the US Dollar Index. The market is looking forward to the US core CPI (consumer price index) data. The data are scheduled to be released at 8:30 AM EST today by the U.S. Bureau of Labor Statistics. Caution ahead of the CPI data is weighing on the US Dollar Index in the early hours. At 5:25 AM EST on May 10, the US Dollar Index was trading at 92.93—a drop of 0.12%.

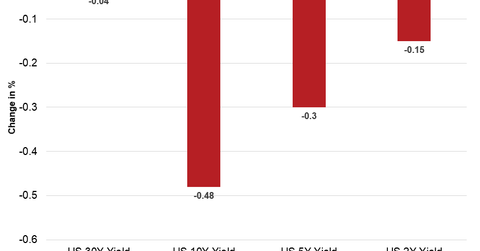

US Treasury yields

US Treasury yields started this week on a stable note and moved past 3% as the week progressed. On Thursday, Treasury yields started the day lower and maintained the weakness ahead of the release of April’s CPI data. Below are the movements in Treasury yields as of 5:30 AM EST on May 10.

- The ten-year Treasury yield was trading at 2.981—a fall of ~0.48%.

- The 30-year Treasury yield was trading at 3.153—a fall of ~0.04%.

- The five-year Treasury yield was trading at 2.830—a fall of ~0.3%.

- The two-year Treasury yield was trading at 2.526—a fall of ~0.15%.

The iShares 20+ Year Treasury Bond (TLT) declined 0.6%, while the ProShares UltraPro Short 20+ Year Treasury (TTT) and the ProShares UltraShort 20+ Year Treasury (TBT) gained 1.8% and 1.2%, respectively, on Wednesday.

Next, we’ll discuss how commodities performed in the early hours on May 10.