US Dollar Index Consolidates in the Early Hours

In the early hours on November 22, the US Dollar Index is trading with weakness below the opening prices.

Nov. 22 2017, Published 8:13 a.m. ET

US Dollar Index

After falling for two consecutive trading weeks, the US Dollar Index started this week on a stronger note. However, the US Dollar Index lost momentum on Tuesday and opened lower on Wednesday. In the early hours on November 22, the US Dollar Index is trading with weakness below the opening prices.

Market performance

The US Dollar Index rose on Monday but lost upward momentum on Tuesday. On November 22, the US Dollar Index is consolidating. The market is waiting for the FOMC meeting minutes, which will be released at 2:00 PM EST today. The market is also looking forward to the release of October’s core durable goods orders and initial jobless claims data at 8:30 AM EST. With no major economic releases scheduled until the end of the month, the progress in US tax reform plans is expected to move the US Dollar Index.

At 5:25 AM EST on November 22, 2017, the US Dollar Index was trading at 93.84—a fall of 0.12%.

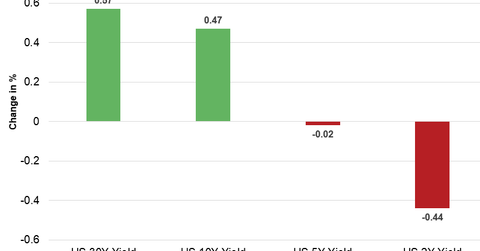

US Treasury yields

In the early hours on November 22, the short-term yields are weak and long-term yields are stable. The two-year yield rose to nine-year high price levels on Tuesday. However, it’s weak in the early hours today due to profit-booking.

Movement in Treasury yields

Below are the movements in Treasury yields as of 5:30 AM EST on November 22.

- The ten-year Treasury yield was trading at 2.372—a rise of ~0.47%.

- The 30-year Treasury yield was trading at 2.779—a rise of ~0.6%.

- The five-year Treasury yield was trading at 2.107—a fall of ~0.02%.

- The two-year Treasury yield was trading at 1.768—a fall of ~0.42%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.32%. The ProShares UltraPro Short 20+ Year Treasury (TTT) fell 0.96% and the ProShares UltraShort 20+ Year Treasury (TBT) fell 0.64% on November 21.

In the next part of this series, we’ll discuss how commodities performed in the early hours on November 22.