Putting the Factors Together

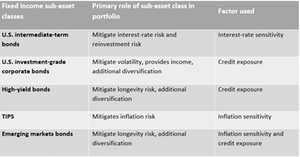

Each factor of a fixed-income portfolio—so interest-rate sensitivity, credit exposure, and inflation sensitivity—may play an important role in constructing a dynamic fixed-income portfolio for target date investing.

Nov. 21 2017, Published 2:16 p.m. ET

Each factor of a fixed-income portfolio—so interest-rate sensitivity, credit exposure, and inflation sensitivity—may play an important role in constructing a dynamic fixed-income portfolio for target date investing. These might help improve retiree outcomes because they seek to limit interest-rate and reinvestment risk, benefit from credit exposure to yield-advantaged sectors, and maintain purchasing power by allocating to sectors whose returns keep pace with or outpace inflation.

Additional resources

- Factor-based equity strategies for retirement investing

- Equity factors in focus for target date portfolios

- Equity factors in focus for retirement investing

- How factors influence equity and fixed-income returns

The target date represents the year in which investors may likely begin withdrawing assets. The investments gradually seek to reduce market risk as the target date approaches and after it arrives by decreasing equity exposure and increasing fixed-income exposure. The principal value is not guaranteed at any time, including at the target date.

The strategies invest in alternative investments, such as short sales, which are speculative and entail a high degree of risk. The strategies invest using alternative investment strategies, such as equity hedged, event driven, global macro, and relative value, which are speculative and entail a high degree of risk. Alternative investments, such as commodities and merger arbitrage strategies, are speculative and entail a high degree of risk. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the strategies. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the strategies and its share price can be sudden and unpredictable. High-yield securities have a greater risk of default and tend to be more volatile than higher-rated debt securities. The use of derivatives may reduce returns and/or increase volatility. Securities issued by U.S. government agencies or government-sponsored entities may not be guaranteed by the U.S. Treasury. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The strategies are exposed to foreign investment risk, mortgage- and asset-backed securities risk, new security risk, regulatory risk, and smaller-company investment risk. Consult the strategies prospectus or offering document for additional information on these and other risks.