Why Groupon’s Debt-to-Equity Ratio Is One of Highest in Industry

Groupon (GRPN), eBay (EBAY), Baidu (BIDU), Square (SQ), and Twitter (TWTR) have the highest debt-to-equity ratios among industry players.

Nov. 20 2020, Updated 12:29 p.m. ET

High debt to equity implies heavy borrowing

Groupon (GRPN), eBay (EBAY), Baidu (BIDU), Square (SQ), and Twitter (TWTR) have the highest debt-to-equity ratios among industry players. Debt to equity is an indicator of the extent to which a company increases its value by using debt to fund projects. Therefore, a higher debt-to-equity ratio implies that a company is borrowing a lot to finance its growth.

While a company can leverage debt to grow its sales and earnings at a more rapid pace than it would without such financing, the cost of debt can sometimes erode the returns due to high interest expenses.

Groupon has most leveraged growth

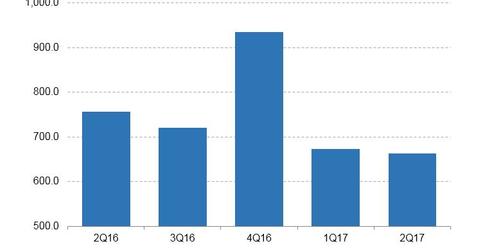

Groupon, a leader in online shopping deals, has a debt-to-equity ratio of 126.12x. The company generated $662.6 million in revenue in 2Q17, which was down 8.0%. However, Groupon’s bottom line improved to an adjusted EPS (earnings per share) of $0.02, up from an EPS loss of $0.01 a year earlier.

eBay has a debt to equity of 99.93x. The company reported that its revenue rose 4.5% to $2.3 billion in 2Q17. The revenue was better than the consensus estimate by $20 million.

Baidu has a debt-to-equity ratio of 84.82x. The Chinese Internet search company’s revenue rose 14.3% to $3.1 billion in 2Q17. Square has a debt-to-equity ratio of 49.73x. The company’s sales rose nearly 26% to $551.5 million in 2Q17, exceeding consensus estimates by more than $15 million.

Despite leverage, Twitter struggles for growth

Twitter, the social media company competing with Facebook, Snap, Yelp, and Alphabet’s Google in the online advertising market, has a debt-to-equity ratio of 36.92x. Twitter’s sales fell 4.6% year-over-year to $574 million in 2Q17. However, the company still managed to surpass the consensus top-line estimate by more than $37 million.

Amazon and Alibaba are other Internet companies with debt-to-equity ratios in the double-digit territory.