US Dollar Index and Treasury Yields Are Stable

The US Dollar Index started this week on a stronger note by rebounding on Monday. The US Dollar Index opened Tuesday on a stable note.

Dec. 5 2017, Published 8:32 a.m. ET

US Dollar Index

After regaining stability last week, the US Dollar Index started this week on a stronger note by rebounding on Monday. The US Dollar Index opened Tuesday on a stable note and traded above the opening prices in the early hours.

Market sentiment

The market sentiment on the US Dollar Index has improved this week amid progress made in making the tax reform plan a reality. After rising the most in a week on Monday, the US Dollar Index lost momentum on Tuesday but traded at elevated levels. The market is looking forward to the release of October’s trade balance data and November’s services PMI data that are scheduled to release today.

At 6:20 AM EST today, the US Dollar Index is trading at 93.12—a fall of 0.08%.

US Treasury yields

US Treasury yields started this week on a stronger note by closing Monday with gains. The improved market sentiment amid tax plan progress supported US bond yields. The bonds weakened amid the market’s increased risk appetite. The yields moved against bonds’ movements and traded with strength in the early hours on Tuesday.

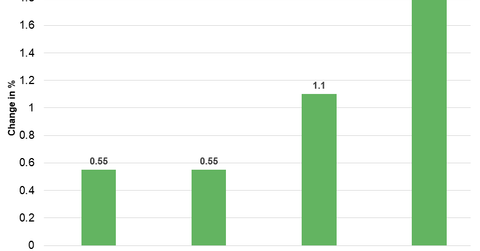

Below are the movements in Treasury yields as of 6:20 AM EST on December 5.

- The ten-year Treasury yield was trading at 2.376—a gain of ~0.55%.

- The 30-year Treasury yield was trading at 2.773—a gain of ~0.55%.

- The five-year Treasury yield was trading at 2.141—a gain of ~1.0%.

- The two-year Treasury yield was trading at 1.810—a gain of ~1.8%.

The iShares 20+ Year Treasury Bond (TLT) rose 0.05%. The ProShares UltraPro Short 20+ Year Treasury (TTT) fell 0.04% and the ProShares UltraShort 20+ Year Treasury (TBT) fell 0.06% on December 4.

In the next part of this series, we’ll discuss how commodities performed in the early hours on December 5.