Tronox Will Raise $450 Million through Senior Notes

On September 14, 2017, Tronox (TROX) announced that it will raise $450 million through senior notes. The notes will mature in 2025.

Sept. 18 2017, Updated 3:06 p.m. ET

Tronox will issue senior notes

On September 14, 2017, Tronox (TROX) announced that it will raise $450 million through senior notes. The offer was made to qualified institutional buyers at par and carries a coupon rate of 5.8%. The interest will be paid semi-annually. The notes will mature in 2025. The offer is expected to close on September 22, 2017—subject to closing conditions. The offer was made through Tronox’s subsidiary—Tronox Finance.

The proceeds from the notes, along with additional borrowing from the new credit facility, will be used to redeem the outstanding amount of $900 million senior notes due in 2020. They carry a coupon rate or 6.38%. As a result, we can expect Tronox’s interest expense to fall. At the end of 2Q17, Tronox had an outstanding debt of ~$3.0 billion including long-term and short-term debt. Tronox’s interest expense was $92 million for the same period.

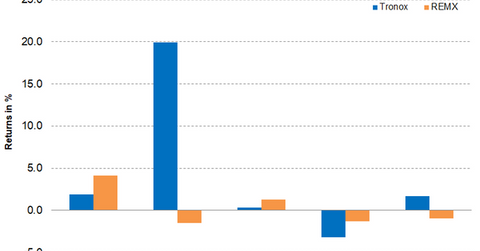

Tronox’s stock performance

Tronox continued its upward journey. The stock rose 2.40% and closed at $22.96. The stock traded 29.50% above the 100-day moving average price of $17.73, which indicates the upward trend in the stock. However, investors need to be cautious. The 14-day relative strength index of 72 indicates that the stock temporarily moved into an overbought situation. Tronox is also trading 20.80% above the target price recommended by analysts’ consensus. On a year-to-date basis, the stock has returned 122.70%. Tronox’s peers FMC (FMC), Albemarle (ALB), and Chemocurs (CC) have returned 58.40%, 47.90%, and 128%, respectively.

Investors looking to invest indirectly in Tronox can invest in the Rare Earth/Strategic Metals ETF (REMX). REMX has invested 6.0% of its portfolio in Tronox as of September 15, 2017.