Key Updates in the Consumer Sector: December 18–22, 2017

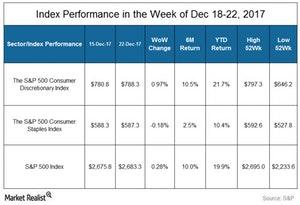

The S&P 500 Consumer Discretionary Index (21.7%) has outperformed the S&P 500 Index (19.9%) and the S&P 500 Consumer Staples Index (10.4%) on a YTD basis.

Dec. 26 2017, Updated 9:02 a.m. ET

Index’s performance

As of December 22, the S&P 500 Consumer Discretionary Index (21.7%) has outperformed the S&P 500 Index (19.9%) and the S&P 500 Consumer Staples Index (10.4%) on a YTD (year-to-date) basis.

Few key updates from last week

On December 18, Campbell Soup (CPB) announced that it agreed to acquire Snyder’s-Lance (LNCE) for $50.00 per share in an all-cash transaction. The company expects the acquisition to help expand its portfolio of leading snack brands.

On December 22, Walgreens Boots Alliance (WBA) announced its agreement to reduce its stake in Guangzhou Pharmaceuticals. After regulatory review and approval, the company plans to sell 30% interest in Guangzhou Pharmaceuticals to Guangzhou Baiyunshan Pharmaceutical Holdings. The stock rose 1.1% last week.

On December 18, The Hershey Company (HSY) entered into a definitive agreement with Amplify Snack Brands (BETR) to acquire all of the company’s outstanding shares for $12.00 per share in cash. The deal is expected to close in 1Q18. The stock rose 0.7% last week.

On December 21, Conagra Brands (CAG) announced its definitive agreement to acquire the Sandwich Bros. of Wisconsin. The company produces frozen breakfast and entree flatbread sandwiches. The deal is expected to close in early 2018. The stock rose 0.8% last week.