How Invesco’s Dividend Yield Curve Has Evolved

Revenue and earnings Investment management company Invesco (IVZ) saw its revenue fall 8% in 2016, after flat growth in 2015. In 2016, its investment management, service and distribution, and performance fees fell. Its operating expenses fell 3%–5% in 2015 and 2016, and its operating income fell 13% in 2016 after rising 6% in 2015. Meanwhile, its […]

Sept. 18 2017, Published 11:21 a.m. ET

Revenue and earnings

Investment management company Invesco (IVZ) saw its revenue fall 8% in 2016, after flat growth in 2015. In 2016, its investment management, service and distribution, and performance fees fell.

Its operating expenses fell 3%–5% in 2015 and 2016, and its operating income fell 13% in 2016 after rising 6% in 2015. Meanwhile, its interest expenses rose 12%–14%. Its EPS (earnings per share) fell 9% in 2016, and were flat in 2015.

Revenue and EPS in 1H17

Invesco’s revenue grew 5% in 1H17, driven by all segments. Its operating expenses rose 6%, its operating income was flat, and its interest expenses rose 3%. As a result, its EPS rose 4%.

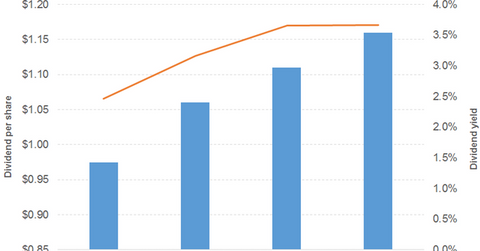

Dividend

The company has consistently increased its dividend over the years. Its dividend payout varied slightly between 2014 to 2016, and rose between 1H16 and 1H17.

Stock price

Invesco stock has been beaten by the First Trust Financials AlphaDEX ETF (FXO) since 2H15.