Celanese Continues to Hike Its Product Prices

On September 14, 2017, Celanese (CE) announced that it’s increasing the prices for several of its products across different regions.

Sept. 18 2017, Updated 4:36 p.m. ET

Celanese continues its price hikes

On September 14, 2017, Celanese (CE) announced that it’s increasing the prices for several of its products across different regions. The price impact will be effective on October 1 or as the contract allows. Below is the list of price changes:

- Acetic Acid and Acetic Anhydride prices will increase by 300 renminbi per metric ton in China.

- VAM (Vinyl Acetate Monomer) prices increased by $0.12 per pound in the US and Canada, $400 per metric ton in South America and the Middle East, and Africa, 200 euros per metric ton in Europe, 300 renminbi per metric ton in China, and $50 per metric ton in Asia—excluding China. VAM’s price increase is above the previous price hikes announced on September 6 and September 13 specifically for China and Asia—excluding China.

- Vinyl Acetate-Ethylene, VAM Homopolymers, Vam Copolymers, and Styrene Acrylics prices rose by 90 euros per metric ton in Europe and $110 per metric ton in the Middle East and Africa.

- Pure Acrylics prices will rise by 120 euros per metric ton in Europe and $145 per metric ton in the Middle East and Africa.

The price impact will be visible in 4Q17. The price increase could help Celanese improve its revenue in 4Q17 if the volumes don’t fall on a year-over-year basis. In 2Q17, the Acetyl Intermediates segment reported revenues of $649 million—a rise of 9.60% compared to its revenues in 2Q16.

Celanese’s stock price

Celanese’s stock price rose 3.4% for the week ending September 15, 2017, and closed at $100.09. Gains in the stock price caused Celanese to trade 7.40% above the 100-day moving average price of $93.23, which reflects the prevailing upward trend in the stock. On a year-to-date basis, the stock has risen 27.10%. Celanese’s 14-day relative strength index of 62 indicates that the stock isn’t overbought or oversold.

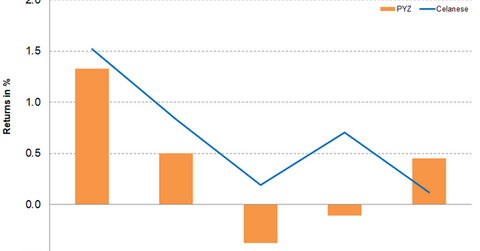

Celanese outperformed the PowerShares DWA Basic Materials Momentum Portfolio (PYZ), which returned 1.80% for the week ending September 15, 2017. PYZ has invested 3.20% of its portfolio in Celanese. The fund’s other holdings include Chemours (CC), FMC (FMC), and LyondellBasell (LYB) with weights of 4.90%, 4.70%, and 3.70%, respectively, as of September 15, 2017.