Can RPM International Outperform the Analysts’ Revenue Estimate for Fiscal 1Q18?

As of September 25, 2017, analysts have forecasted that RPM will report revenues of $1.32 billion for fiscal 1Q18, which would be a 5.5% rise over fiscal 1Q17.

Sept. 27 2017, Updated 3:36 p.m. ET

Analysts’ revenue expectations

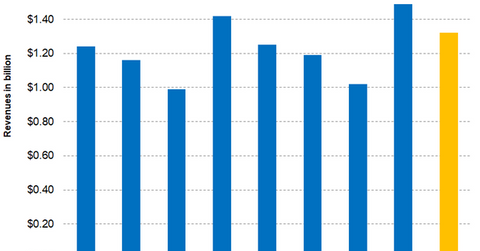

As of September 25, 2017, analysts have forecast that RPM International (RPM) will report revenues of ~$1.3 billion for fiscal 1Q18, which would be a 5.5% rise over fiscal 1Q17. RPM’s first quarter revenues from 2012 to 2017 have grown at a CAGR (compound annual growth rate) of 4.7%, but it remains to be seen if RPM’s revenues for fiscal 1Q18 can grow above its current CAGR.

Driving factors

RPM’s expected revenue growth will likely be driven by the nine acquisitions that RPM executed in fiscal 2017. The combined sales of these acquisitions are expected to be ~$220 million per year, but the weakness in the US dollar could push revenues up. The dollar index between June 2017 and August 2017 has fallen 4.4%.

Meanwhile, the data on the new house and the construction space has shown an upward trend on a YoY (year-over-year) basis. RPM has also boosted its product prices, which should help to grow revenues.

Other factors

RPM’s Kirker nail enamel business has been on a declining trend and could have an adverse impact on revenues. Its Brazilian operations could fall as well from last year, when it saw benefits from the Olympics in the first quarter.

Investors can indirectly hold RPM International stock by investing in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ), which has 1.9% of its portfolio in RPM international. PYZ’s other holdings include Chemours (CC), FMC (FMC), and Albemarle (ALB), which had weights of 4.9%, 4.5%, and 3.9%, respectively, on September 25, 2017.

In the next part, we’ll discuss other analyst expectations for RPM’s fiscal 1Q18 earnings.