Why Tencent’s Growth Story Is Not Over

Tencent posts record earnings and revenue Tencent Holdings (TCEHY), China’s biggest gaming and social media company by revenue, reported its fiscal 2Q17 results on Wednesday, August 16. The Shenzhen-based company beat forecasts and reported its best-ever quarterly results. Its strong results were driven by higher income from its popular Honor of Kings mobile game, triple-digit growth […]

Sept. 8 2017, Updated 5:46 p.m. ET

Tencent posts record earnings and revenue

Tencent Holdings (TCEHY), China’s biggest gaming and social media company by revenue, reported its fiscal 2Q17 results on Wednesday, August 16. The Shenzhen-based company beat forecasts and reported its best-ever quarterly results. Its strong results were driven by higher income from its popular Honor of Kings mobile game, triple-digit growth in payment services, and online advertising.

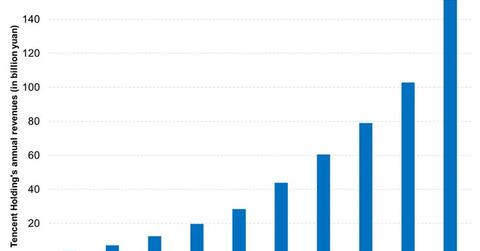

Tencent’s earnings surged 70% between fiscal 2Q16 and fiscal 2Q17, to 18.2 billion yuan (or ~$2.7 billion). The company’s revenue, which has been hitting new highs every quarter since 2007, soared by 59% YoY (year-over-year) to 56.6 billion yuan (or $8.4 billion). Wall Street was expecting earnings of 14.2 billion yuan and revenue of 53.0 billion yuan.

Mobile games, online ads, and payment services boosted

Tencent’s social advertising revenue rose 61% YoY to 6 billion yuan. WeChat, which accounts for most of the company’s social ad revenue, has 963 million monthly active users—20% more than in 2Q16. The company has been successful in monetizing its active user base.

According to App Annie, Honor of Kings has been a top global mobile game since March, and has boosted the company’s smartphone-game revenue by 54% YoY. Its revenue from PC (personal computer) games rose 29%, despite the declining PC industry.

China’s (FXI) swift approval of the cashless regime helped the company post 177% YoY growth in its “other” revenue, which consists of cloud and payment services. China’s mobile payment transactions saw an 86% surge in 2016, according to data from Bank of China. Tencent and Alibaba’s (BABA) Alipay dominate the country’s digital payment space.

Tencent stock, which has surged by 70% in 2017, climbed 6% on the New York Stock Exchange on Wednesday. The company now has a market capitalization of nearly $390 billion.