Why Cisco Systems Is Focusing on Software and Services

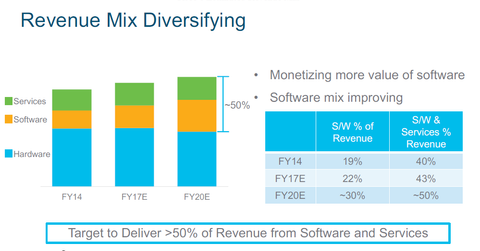

Cisco’s Services aims to grow its Software revenue from 19.0% of its total revenue in fiscal 2014 to 22.0% in fiscal 2017 and 30.0% in fiscal 2020.

Aug. 14 2017, Updated 7:35 a.m. ET

Software and Services to account for 50% of revenue by fiscal 2020

Earlier in this series, we saw that Cisco Systems’ (CSCO) Services segment revenue has grown 3.0% YoY (year-over-year) in the first nine months of fiscal 2017, compared to an overall fall in revenue of 1.0% YoY. Cisco’s Services business accounts for approximately 26.0% of its total revenue. Cisco aims to grow its Software revenue from 19.0% of its total revenue in fiscal 2014 to 22.0% in fiscal 2017 and 30.0% in fiscal 2020.

Growing Software revenue

Cisco’s Software revenue has grown from $8.0 billion in fiscal 2014 to $11.0 billion in fiscal 2017. Cisco expects its Software revenue to grow at a CAGR (compound annual growth rate) of 12.0%–15.0% from fiscal 2017 to fiscal 2020. In fiscal 2017, Cisco expects its Software revenue to account for 14.0% of its infrastructure revenue. That figure stands at 47.0%, 58.0%, and 16.0% for its Security, Applications, and Services business segments, respectively.

While Cisco’s Systems’ Software revenue will be perpetual in nature, the company wants 30.0% in subscription revenues for its On-Premise Software vertical. In the Hybrid Software and SaaS (software as a service) verticals, Cisco is offering a 100% subscription revenue model, which means revenue in these segments will be recurring in nature. Cisco aims to grow its recurring revenue to 37.0% of its total revenue by the end of fiscal 2020, which would be a 26.0% rise in fiscal 2014 and a 30.0% rise in fiscal 2017.

Increasing its Software revenue will also mean an improvement in profit margins and earnings per share.