Ashland Hikes Prices of Gelcoat in EMEA

On August 25, 2017, Ashland (ASH) announced that it would hike the prices of its Gelcoat portfolio. The price hike will be 75 euros per metric ton.

Aug. 28 2017, Published 4:35 p.m. ET

Ashland hikes prices

On August 25, 2017, Ashland (ASH) announced that it would hike the prices of its Gelcoat portfolio. The price hike will be 75 euros per metric ton and should impact the EMEA (Europe, the Middle East, and Africa) region.

This price hike will be effective as of September 1, 2017, or as the contract allows and was enacted due to an increase in the price of raw materials like titanium dioxide, isophthalic acid, and neopentyl glycol.

The price hike should have a positive impact on ASH’s Composite segment from fiscal 4Q17, assuming that volumes remain steady or increase over those of the previous year. This segment reported revenues of $209 million in fiscal 3Q17, representing a growth of 20.1% on a YoY (year-over-year) basis.

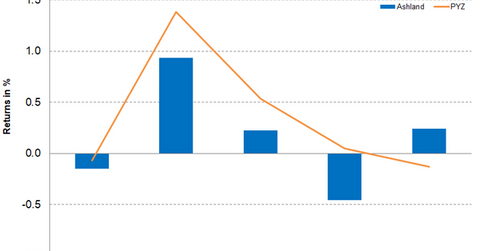

Ashland’s stock price movement for the previous week

Ashland stock gained 0.8% and closed at $61.47 last week (ended August 25, 2017). Despite these gains, the stock was trading 3.7% below its 100-day moving average price of $63.82, indicating a prevailing weakness in the stock. On a YTD (year-to-date) basis, the stock has returned 15.0%.

Analysts appear to be bullish on the stock and have recommended a target price of $72.75 over the next 12 months, implying a potential return of 18.4% from its closing price of $61.47 on August 25, 2017. ASH’s relative strength index of 38 indicates that the stock is neither overbought nor oversold.

Investors looking for indirect exposure to Ashland can invest in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ), which has 3.3% of its portfolio in Ashland. PYZ also provides exposure to Chemours (CC), Albemarle (ALB), and LyondellBasell (LYB), which had weights of 4.8%, 3.7%, and 3.6%, respectively, on August 25, 2017.