What Lies Ahead for American Tower

For fiscal 2017, American Tower expects to report property revenues that would be 14% higher on a year-over-year basis, or by $25 million.

July 31 2017, Updated 1:36 p.m. ET

AMT’s robust 2Q17 top and bottom lines

American Tower (AMT) posted robust top-line and bottom-line results for 2Q17, beating its results in 2Q16 on the high demand of its tower estates worldwide.

Factors affecting profit during 2Q17

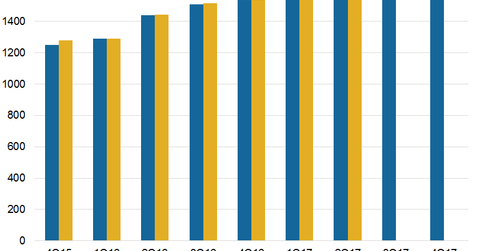

AMT’s FFO (funds from operations) stood at $1.58 per share, which was in line with Wall Street estimates. The results were ~19% higher YoY (year-over-year) and represent the 17th consecutive quarter that AMT has surpassed the mark on a YoY basis.

Higher organic tenant billing, rent growth, strategic investments in expansion, and prudent cost-control measures helped American Tower maintain growth in profits during the quarter. Consolidated property revenues soared 15% YoY, backed by tenant billing growth of 12%. Organic tenant billing contributed 8% to growth during the period.

Strong momentum, enhanced guidance

American Tower has raised the midpoint of the fiscal 2017 outlook for its expected property revenue, net income, EBITDA, and adjusted FFO. AMT now expects to report property revenues that would be 14% higher YoY, or by $25 million. It now expects to report a revenue in the range of $6.48 billion–$6.58 billion.

The midpoint for fiscal 2017 is expected to be 14.3% higher YoY, which reflects a better-than-expected performance in international business, positive foreign exchange assumptions, and lower churn rates assumed in India.

EBITDA outlook

American Tower has also raised its outlook for adjusted EBITDA by 1% due to higher YoY tenant billings and strong cost controls. EBITDA is expected to be $4.04 billion–$4.10 billion, or 14.7% higher YoY at the midpoint.

Apart from the higher property revenue and EBITDA, AMT has also raised its adjusted FFO guidance for fiscal by $555 million, or by 2%, due to lower expected maintenance costs, higher EBITDA, and a favorable interest rate. Its adjusted FFO for fiscal 2017 is expected to be $2.83 billion–$2.88 billion, or 14.8% higher at the midpoint.

By comparison, close competitors Realty Income Properties (O), SBA Communications (SBAC), and Crown Castle International (CCI) reported adjusted FFOs of $0.75, $1.16, and $1.70, respectively, for 2Q17. AMT and these peers make up ~17% of the ProShares Ultra Real Estate ETF (URE).