JCPenney: Analysts’ Recommendations and Target Price

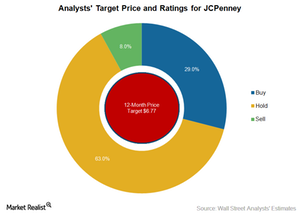

As of July 13, 15 analysts covering JCPenney (JCP) stock have a “hold” rating. Seven analysts have a “buy” rating, while two analysts have a “sell” rating.

Nov. 20 2020, Updated 10:48 a.m. ET

Analysts’ recommendations

As of July 13, 63% or 15 out of 24 analysts covering JCPenney (JCP) stock have a “hold” rating. Seven analysts have a “buy” rating, while two analysts have a “sell” rating. On June 26, Gordon Haskett upgraded JCPenney stock to “hold” from “reduce” with a target price of $4.50.

Consensus “hold” rating

JCPenney has been taking several measures to improve its performance. The initiatives include focusing on categories like beauty and home. In its beauty business, the company continues to expand the number of Sephora stores at JCPenney locations. JCPenney plans to open 70 new locations in fiscal 2017—650 locations by the end of the year. The company has also been rebranding its salons to “Salon by InStyle.” JCPenney thinks that its beauty business will add value to its stores and help increase store traffic.

To improve the performance of its home business, the company is adding higher margin categories to its appliance department like microwaves and mini refrigerators. The company also plans to add new brand partners to the showroom throughout 2017.

Despite aggressive measures, JCPenney’s top line and bottom line will likely be under pressure due to intense competition in the retail sector. Continued investments to support online channel growth and appliance showrooms are also impacting the company’s margins.

12-month price target

As of July 13, the 12-month price target for JCPenney stock was $6.77. The price target reflects 36% upside potential compared to the company’s closing stock price of $4.98 as of July 13.

For more updates, visit Market Realist’s Department Stores page.