Inside American Tower’s 2Q17 Results: What You Need to Know

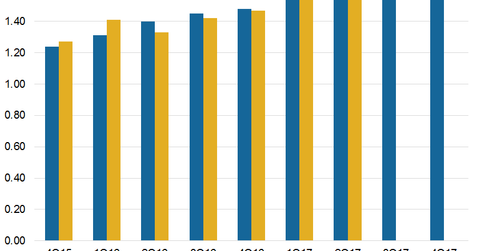

For 2Q17, American Tower (AMT) reported adjusted funds from operation of $1.58 per share, meeting Wall Street estimates and topping 2Q16 by 18.8%.

July 31 2017, Published 11:40 a.m. ET

AMT’s 2Q17 results

For 2Q17, American Tower (AMT) reported adjusted FFO (funds from operation) of $1.58 per share, which met Wall Street estimates and came in 18.8% higher than in 2Q16.

The upswing in profit was the result of a double-digit growth in revenue, driven by strong demand for the company’s assets globally.

American Tower’s 2Q17 revenues of $1.7 billion soared 15.3% higher on a YoY (year-over-year) basis. Its top line surpassed Wall Street’s estimates by 1.2%. This growth was contributed by organic tenant billing growth in both the US and international markets, by 6% and 10%, respectively.

While property revenues gained 14.9% YoY and reached $1.6 billion in 2Q17, tenant billing rose 11.9% YoY to $140 million.

Management comments

In its press release on July 27, 2017, American Tower CEO (chief executive officer) David Jim Taislet stated: “The second quarter of 2017 represented our 17th consecutive quarter of double-digit growth in property revenue, adjusted EBITDA and consolidated AFFO per share, driven by strong demand for our tower real estate from Los Angeles to São Paolo to Paris.

Taislet also stated: “Organic Tenant Billings Growth in the U.S. of over 6% was complemented by organic tenant billings growth of more than 10% in our international markets, where the pace of advanced handset adoption and mobile data usage growth continues to require the addition of substantial network equipment on our sites.”

By comparison, close competitors Realty Income Properties (O), SBA Communications (SBAC), and Crown Castle International (CCI) reported adjusted FFOs of $0.75, $1.16, and $1.70, respectively, for 2Q17. AMT and its peers make up ~17% of the ProShares Ultra Real Estate ETF (URE).