How American Tower Rewarded Stockholders in 2Q17

In 2Q17, American Tower distributed cash worth $275 million among its common stockholders and paid preferred stock dividends totaling $27 million.

Aug. 1 2017, Updated 10:38 a.m. ET

AMT’s dividend payouts

American Tower (AMT) has regularly rewarded its stockholders with quarterly dividends and share buybacks. In 2Q17, American Tower distributed cash worth $275 million among its common stockholders and paid preferred stock dividends totaling $27 million.

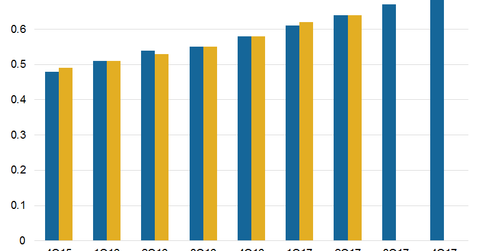

American Tower raised its quarterly dividend by 3.2% to $0.64 in June 2017. The new dividend amounted to an annualized dividend of $2.56. It was paid on July 14, 2017, to shareholders of record on June 15.

American Tower has successfully hiked its dividend once every year by an average of 23.7% for the past five years, and AMT raised its dividend by 22% in fiscal 2016.

AMT has maintained a dividend yield over the past 12 months of 1.69%, compared with ~1.8% and 2% in 2015 and 2016, respectively. It’s expected to maintain a dividend yield of 2% in fiscal 2017, 2.3% in fiscal 2018, and 3% in fiscal 2019.

Repurchases could rise

In 2Q17, AMT repurchased more than 0.3 million shares. So far in fiscal 2017, AMT has repurchased 5.2 million shares worth $641 million, and shares worth $470 million still remain to be purchased under its stock repurchase program.

By comparison, close competitors Crown Castle (CCI), Realty Corporation (O), and Simon Property Group (SPG) offer NTM (next-12-month) dividend yields of 3.8%, 4.4%, and 4.2%, respectively. AMT and its peers constitute ~17% of the ProShares Ultra Real Estate ETF (URE).